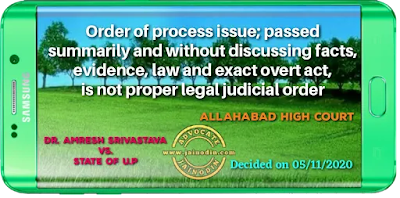

As held by the Courts as above, the passing of order of summoning any person as accused is a very important matter, which initiates criminal proceeding against him. Such orders cannot be passed summarily or without applying judicial mind. [Para No.13]

In light of this legal position I have gone through the impugned order. A perusal of this order indicates that neither any discussion of evidence was made by learned Magistrate, nor was it considered as to which accused had allegedly committed what overt act. The five accused persons of complaint were summoned for offences mentioned in it. Impugned order clearly lacks the reflection of application of judicial discretion or mind. Nothing is there which may show that learned Magistrate, before passing of the order under challenge had considered the facts and circumstances of the case and the evidence or the law. Therefore it appears that, in fact, no judicial mind was applied before the passing of impugned order of summoning. Such order cannot be accepted as a proper legal judicial order passed after following due procedure of law. Therefore it is liable to be quashed.[Para No.14]