It is not necessary to obtain a probate in respect of properties which are not situated whithin the ordinary original civil jurisdiction of the High Courts of Judicature at Madras and Bombay

In view of the rival submissions made on behalf of the parties, it will be necessary to refer to some of the provisions of the Ceiling Act and the Succession Act. Section 29 of the Ceiling Act reads thus:-

"Section 29. (1) Without the previous sanction of the Collector, no land granted under Section 27 or granted to a joint farming society under Section 28 shall be -

(a) transferred, whether by way of sale (including sale in execution of a decree of a Civil Court or of an award or order of any competent authority) or by way of gift, mortgage, exchange, lease or otherwise; or

(b) divided whether by partition or otherwise, and whether by a decree or order of a Civil Court or any other competent authority, such sanction shall not be given otherwise than in such circumstances, and on such conditions including condition regarding payment of premium or nazarana to the State Government, as may be prescribed;

Provided that, no such sanction shall be necessary where land is to be leased by a serving member of the armed forces or where the land is to be mortgaged as provided in Sub-section (4) of Section 36 of the Code for raising a loan for effecting any improvement of such land.

(2) If sanction is given by the Collector to any transfer or division under Sub-section (1) subsequent transfer or division of land shall also be subject to the provisions of Sub-section (1).

(3) Any transfer or division of land, any acquisition thereof, in contravention of Sub-section (1) or Sub-section (2) shall be invalid; and as a penalty therefor, any right, title and interest of the transferor and transferee in or in relation to such land shall, after giving him an opportunity to show cause, be forfeited by the Collector and shall without further assurance vest in the State Government."

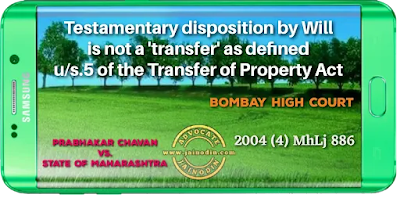

This Court in the aforesaid case of Vimlabai vs. State of Maharashtra, cited supra, after considering the judgments on the point, has held that the transfers which are by act of parties made inter vivos or a result of a decree or an order of the Court, Tribunal or Authority, are alone covered by the said term as defined in Explanation (2) of Section 8 of the Ceiling Act. This Court has further held that it will not include the testamentary dispositions of the property not made inter vivos. Thus, this Court has taken a view that a testamentary disposition by Will is not covered by the word 'transfer' as per the provisions of Section 5 of the Transfer of Property Act. This Court has further while dealing with the certain provisions of the Ceiling Act has in unequivocal terms held that the transfer under the Ceiling Act would not include the testamentary disposition of the property not made inter vivos. In that view of the matter, insofar as the findings of the learned S. D. O. that the transfer is bad in law in view of provisions of Section 29(3) of the said Act is not sustainable in law.[Para No.6]

The next question that arises is whether it is necessary to obtain a probate, so as to claim right as executor or legatee for the lands in question.[Para No.7]

It would be appropriate to refer to certain provisions of the Succession Act. The relevant portion of Section 213 reads as under:-"S. 213. Right as executor or legatee when established. - (1) No right as executor or legatee can be established in any Court of Justice, unless a Court of competent jurisdiction in India has granted probate of the will under which the right is claimed, or has granted letters of administration with the will or with a copy of an authenticated copy of the will annexed.

(2) This section shall not apply in the case of wills made by Muhammadans, and shall only apply -

(i) in the case of wills made by any Hindu, Buddhist, Sikh or Jaina where such wills are of the classes specified in Clauses (a) and (b) of Section 57; and

(ii) ......................................."

Section 57 reads as under :-

"Section 57. Application of certain provisions of Part to be a class of wills made by Hindus, etc. :-

The provisions of this Part which are set out in Schedule III shall, subject to the restrictions and modifications specified therein, apply -

(a) to all Wills and codicils made by any Hindu, Buddhist, Sikh or Jaina on or after the first day of September, 1870, within the territories which at the said date were subject to the Lieutenant-Governor of Bengal or within the local limits of the ordinary original civil jurisdiction of the High Courts of Judicature at Madras and Bombay; and

(b) to all such Wills and codicils made outside those territories and limits so far as relates to immovable property situate within those territories or limits and

(c) to all Wills and codicils made by any Hindu, Buddhist, Sikh or Jaina on or after the first day of January, 1927, to which those provisions are not applied by Clauses (a) and (b):

Provided that marriage shall not revoke any such will or codicil."[Para No.8]

In the case of Jyoti w/o Jagdish Singhai (cited supra) one Padmabai had asked for reference under Section 18 of the Land Acquisition Act and the matter was referred to the Civil Court. During the pendency of the reference, said Padmabai made a Will on 11-4-1974 under which she had bequeathed some immovable properties belonging to her to some persons other than the applicant in the said writ petition. However, by residuary clause in the Will she bequeathed all her movable and immovable properties belonging to her to the applicant in the said writ petition. During the pendency of the proceedings, Padmabai expired on 19-6-1974. The applicant Jyoti by her application applied for her name to be brought on record in the place of Padmabai. In the said application, she had based her claim on the strength of the said Will. An objection was raised that the right to claim compensation could not be considered in the absence of probate or letter of administration from the competent Court. The learned District Judge had directed the applicant Jyoti to obtain probate within a period of three months and stayed the proceedings for that period. That order was subject matter of challenge in the said writ petition.[Para No.9]

This Court while considering the provisions of Section 213 read with Section 57, found that generally if an executor or a legatee claims anything under the Will, he has to obtain a probate or letter of administration if he wants to establish his right in any Court of justice. However, this general rule as contemplated under Section 213 was subject to certain exceptions, which were provided in Sub-section (2) of that Section itself. Sub-section (2) provided that Section 213 will not apply in case of Wills made by Mohammedans but it shall apply only in case of Wills made by Hindus, Buddhists, Sikhs, Jaina where such Wills are of the class specified in Clauses (a) and (b) of Section 57.[Para No

.10]

It can be seen that Clause (a) applies to Wills made by Hindus, Buddhist, Sikhs or Jains on or after 1st day of September, 1870 within the territory mentioned therein. It could further be seen that Clause (a) applies to Wills made within the territories which at the said date were subject to Lieutenant Governor of Bengal or within the local limits of the ordinary original civil jurisdiction of the High Courts of Judicature at Madras or Bombay. It could further be seen that it applies to both movable as well as immovable properties. Then Clause (b) governs all such wills and codicils made outside those territories or limits. Thus, in all the territories excluding the territories included in Clause (a) insofar as they relate to immovable properties, they would be governed by the general rule as contemplated under Section 213.[Para No.11]

Clause (c) of Section 57 deals with all Wills and codicils made by any Hindu, Buddhist, Sikh or Jain on or after the 1st day of January, 1927 to which those provisions are not applied by Clauses (a) and (b).[Para No.12]

It can clearly be seen that the present Will is executed at Yavatmal which is admittedly not covered under the territories included in Clause, (a) of Section 57. For all other territories, if the property is an immovable property, it will be governed by the general rule of Section 213 if the property is an immovable property. However, admittedly, the property in question is not an immovable property. Therefore, the Will of the nature with which we are concerned would be governed by Clause (c) of Section 57. Now referring back to Section 213, it will be clear that the general rule, wherein it has been made necessary to obtain a probate or letter of administration for raising a right as executor or legatee, by virtue of Sub-section (2) has been made applicable to wills made by any Hindu. Buddhist. Sikh or Jaina where such Wills are referable to clauses specified in Clauses (a) and (b) of Section 57. It is, therefore, clear that the Wills of the nature covered by Sub-clause (c) of Section 57 are not covered by the general rule under Section 213, which requires a probate or letter of administration to enable a person to raise a claim to a right as an executor or legatee. The Legislature by exclusion has not made the provisions of Section 213 applicable to the Wills covered under the provisions of Sub-clause (c) of Section 57.[Para No.13]

I am, therefore, in respectful agreement with the view taken by this Court in the aforesaid case of Jyoti, cited supra, wherein it has been held that for the Wills which are covered under Sub-clause (c) of Section 57, it is not necessary to obtain a probate or letter of administration, so as to establish right as an executor or legatee. [Para No.14]

Bombay High Court

Prabhakar Chinappa Chavan

Vs.

State Of Maharashtra

2004 (4) MhLj 886