24 April 2021

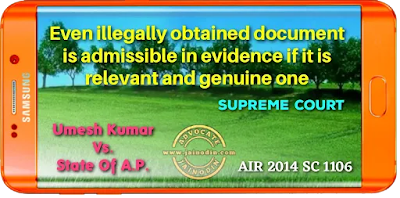

Even illegally obtained document is admissible in evidence if it is relevant and genuine one

16 March 2021

Signed carbon copy prepared in the same process as the original document assumes the character of the original document

13 March 2021

Availability of civil or arbitral remedy for breach of contract, does not mean that initiation of criminal proceedings will be an abuse of the process

11 March 2021

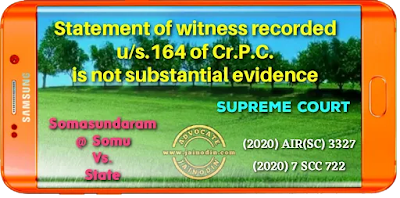

Statement of witness recorded u/s.164 of Cr.P.C. is not substantial evidence

"In making the above and similar comments the trial Court again ignored a fundamental rule of criminaljurisprudence thata statement of a witness recorded under S. 164, Cr.P.C. , cannot be used as substantive evidence and can be used only for the purpose of contradicting or corroborating him. "[Para No.69]

"15. So far as the statement of witnesses recorded under Section 164 is concerned, the object is two fold; in the first place, to deter the witness from changing his stand by denying the contents of his previously recorded statement, and secondly, to tide over immunity from prosecution by the witness under Section 164. A proposition to the effect that if a statement of a witness is recorded under Section 164, his evidence in Court should be discarded, is not at all warranted. (Vide: Jogendra Nahak & Ors. v. State of Orissa & Ors., AIR 1999 SC 2565: (1999 AIR SCW 2736); and Assistant Collector of Central Excise, Rajamundry v. Duncan Agro Industries Ltd. & Ors., AIR 2000 SC 2901) : (2000 Air SCW 3150).

28 February 2021

Deed of gift/hiba executed by a Mohammadan need not required to be registered

"Under the Mahomedan law the three essential requisites to make a gift valid : (1) declaration of the gift by the donor: (2) acceptance of the gift by the donee expressly or impliedly and (3) delivery of possession to and taking possession thereof by the donee actually or constructively.No written document is required in such a case. Section 129 Transfer of Property Act, excludes the rule of Mahomedan law from the purview of Section 123 which mandates that the gift of immovable property must be effected by a registered instrument as stated therein. But it cannot be taken as a sine qua non in all cases that whenever there is a writing about a Mahomedan gift of immovable property there must be registration thereof. Whether the writing requires registration or not depends on the facts and circumstances of each case."[Para No.28]

25 January 2021

Right to vote, contest or dispute election is not fundamental right

12 January 2021

Arbitration agreement bears an independent existence, hence, it can be acted upon, even if the main contract is invalid

31 December 2020

Relatives of the Muslim husband cannot be accused of the offence of pronouncement of triple talaq; the offence can only be committed by a Muslim man

Sec. 7(c) of Muslim Women (Protection of Rights on Marriage) Act 2019 does not impose an absolute bar on granting regular or anticipatory bail

27 December 2020

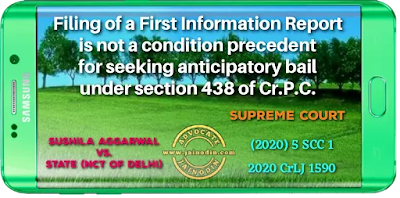

filing of a first information report is not a condition precedent to the exercise of the power under Section 438 of Cr.P.C.

(i) Grant of an order of unconditional anticipatory bail would be “plainly contrary to the very terms of Section 438.” Even though the terms of Section 438(1) confer discretion, Section 438(2) “confers on the court the power to include such conditions in the direction as it may think fit in the light of the facts of the particular case, including the conditions mentioned in clauses (i) to (iv) of that sub-section.”

(ii) Grant of an order under Section 438(1) does not per se hamper investigation of an offence; Section 438(1)(i) and (ii) enjoin that an accused/applicant should co-operate with investigation. Sibbia (supra) also stated that courts can fashion appropriate conditions governing bail, as well. One condition can be that if the police make out a case of likely recovery of objects or discovery of facts under Section 27 (of the Evidence Act, 1872), the accused may be taken into custody. Given that there is no formal method prescribed by Section 46 of the Code if recovery is made during a statement (to the police) and pursuant to the accused volunteering the fact, it would be a case of recovery during “deemed arrest” (Para 19 of Sibbia).

(iii)

(iv) While the power of granting anticipatory bail is not ordinary, at the same time, its use is not confined to exceptional cases (Para 22, Sibbia).

(v) It is not justified to require courts to only grant anticipatory bail in special cases made out by accused, since the power is extraordinary, or that several considerations – spelt out in Section 437- or other considerations, are to be kept in mind. (Para 24-25, Sibbia).

(vi) Overgenerous introduction (or reading into) of constraints on the power to grant anticipatory bail would render it Constitutionally vulnerable. Since fair procedure is part of Article 21, the court should not throw the provision (i.e. Section 438) open to challenge “by reading words in it which are not to be found therein.” (Para 26).

(vii) There is no “inexorable rule” that anticipatory bail cannot be granted unless the applicant is the target of mala fides. There are several relevant considerations to be factored in, by the court, while considering whether to grant or refuse anticipatory bail. Nature and seriousness of the proposed charges, the context of the events likely to lead to the making of the charges, a reasonable possibility of the accused’s presence not being secured during trial; a reasonable apprehension that the witnesses might be tampered with, and “the larger interests of the public or the state” are some of the considerations.

(viii) There can be no presumption that any class of accused- i.e. those accused of particular crimes, or those belonging to the poorer sections, are likely to abscond. (Para 32, Sibbia).

(ix) Courts should exercise their discretion while considering applications for anticipatory bail (as they do in the case of bail). It would be unwise to divest or limit their discretion by prescribing “inflexible rules of general application.”. (Para 33, Sibbia).

(x) The apprehension of an applicant, who seeks anticipatory bail (about his imminent or possible arrest) should be based on reasonable grounds, and rooted on objective facts or materials, capable of examination and evaluation, by the court, and not based on vague un-spelt apprehensions. (Para 35, Sibbia).

(xi)

(xii)

(xiii) Anticipatory bail can be granted even after filing of an FIR- as long as the applicant is not arrested. However, after arrest, an application for anticipatory bail is not maintainable. (Para 38-39, Sibbia).

19 December 2020

Dispute between landlord and tenant is arbitrable in case of lease and it is non arbitrable in case if Rent Act is applicable

17 December 2020

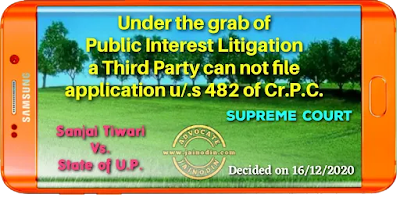

Under the grab of Public Interest Litigation a Third party can not file application u/s. 482 of Cr.P.C.

22 November 2020

In an inquiry under Section 202 Cr.P.C., the Magistrate is required to consider whether the civil dispute is tried to be given a colour of criminal dispute or not

20 November 2020

Mentioning of a wrong provision or non-mentioning of any provision of law would, by itself, be not sufficient to take away the jurisdiction of a court if it is otherwise vested in it in law

24 October 2020

Relief not founded on the pleadings should not be granted

16 October 2020

While releasing accused on default bail u/s.167(2) of Cr.P.C. the court can not impose any condition of depositing cash amount or to report before police station daily

15 October 2020

Residence Order passed under The Protection of Women from Domestic Violence Act does not impose any embargo for filing or continuing civil suit seeking permanent injuction against daughter-in-law

10 October 2020

Mere registration of FIR regarding ragging of a student is not the ground for suspending the accused-student from educational institute

Before suspending accused-student, the educational institute must get satisfied itself about the truth of allegations of ragging

07 October 2020

Court cannot grant a relief which has not been specifically pleaded and prayed by the parties

"It is well settled thatthe decision of a case cannot be based on grounds outside the pleadings of the parties and it is the case pleaded that has to be found. Without an amendment of the plaint, the Court was not entitled to grant the relief not asked for and no prayer was ever made to amend the plaint so as to incorporate in it an alternative case."[Para No.29]

"Though the Court has very wide discretion in granting relief, the court, however, cannot, ignoring and keeping aside the norms and principles governing grant of relief, grant a relief not even prayed for by the petitioner."[Para No.31]

02 October 2020

Financier is the real owner of a vehicle, covered by a hire purchase agreement till all the hire instalments are paid

The Consumer Protection Act, 1986 does not override the Contract Act, 1872, and other enactments

"Consumer is a merely a trustee of vehicle under hire-purchase agreement"

“5. Hire-purchase agreements are executory contracts under which the goods are let on hire and the hirer has an option to purchase in accordance with the terms of the agreement. These types of agreements were originally entered into between the dealer and the customer and the dealer used to extend credit to the customer. But as hire- purchase scheme gained in popularity and in size, the dealers who were not endowed with liberal amount of working capital found it difficult to extend the scheme to many customers. Then the financiers came into the picture.The finance company would buy the goods from the dealer and let them to the customer under hire-purchase agreement. The dealer would deliver the goods to the customer who would then drop out of the transaction leaving the finance company to collect instalments directly from the customer. Under hire-purchase agreement, the hirer is simply paying for the use of the goods and for the option to purchase them. The finance charge, representing the difference between the cash price and the hire-purchase price, is not interest but represents a sum which the hirer has to pay for the privilege of being allowed to discharge the purchase price of goods by instalments. 7. In Damodar Valley Corpn. v. State of Bihar AIR 1961 SC 440 this Court took the view that a mere contract of hiring, without more, is a species of the contract of bailment, which does not create a title in the bailee, but the law of hire purchase has undergone considerable development during the last half a century or more and has introduced a number of variations, thus leading to categories and it becomes a question of some nicety as to which category a particular contract between the parties comes under.Ordinarily, a contract of hire purchase confers no title on the hirer, but a mere option to purchase on fulfilment of certain conditions. But a contract of hire purchase may also provide for the agreement to purchase the thing hired by deferred payments subject to the condition that title to the thing shall not pass until all the instalments have been paid. There may be other variations of a contract of hire purchase depending upon the terms agreed between the parties. When rights in third parties have been created by acts of parties or by operation of law, the question may arise as to what exactly were the rights and obligations of the parties to the original contract.[Para no.64]

In Charanjit Singh Chadha (supra), this Court held that