30 September 2020

Chairman/Managing Director of a news channel/house can be held liable for publication of the offending news item only if he has any role in selecting the news and publishing the same with active knowledge and intent

When applicant is arrayed as accused because he is the owner of vehicle involved in sand theft crime then without swaying into the controversy of manipulation/mismatching of engine/chassis number, vehicle can be returned u/s.457 to him

However as can be discerned, the matter has become complicated because of changes in the chassis and engine numbers appearing on the tractor. The panchnama under which the tractor was seized mentions that at the time of such seizure the chassis number was appearing as "0065110367V1DH" and the engine number was appearing as "CO6014709VIDK013B". Apparently no photograph of such number as they were appearing on the chassis and engine were taken. The petitioner had applied for release of the tractor earlier to the present attempt by filing Criminal M.A. No.569/2017 but it was rejected since the numbers obviously did not tally. He preferred Criminal Revision No.220/2017. It was dismissed but a direction was given to the RTO to inspect and to register the vehicle. Pursuant to such a direction the Magistrate called upon the RTO concerned to undertake the inspection and to register the tractor since it was not registered till then with the RTO. It is apparent that the RTO thereafter undertook the inspection on 26.12.2018 (page 40) and submitted a report on the same date to the Superintendent of the Civil Court at Sillod. In addition he sent another letter dated 08.01.2019 (page 43). It was mentioned that the tractor was having chassis number and engine number which tally with the original numbers mentioned by the dealer on the Tax Invoice (Exhibit B). However, he also notice that the tractor was not in a road worthy condition and therefore for the reasons mentioned therein he was unable to register it because of various provisions contained in the Motor Vehicles Act and the Rules framed thereunder. It is in the backdrop of such state of affairs that now we are faced with the situation.[Para No.13]

29 September 2020

For the purpose of deciding the period of notice of termination of lease, only the purpose for which the property was let out has to be seen and subsequent change in user would not change the nature of lease

Coming to the issue regarding validity of notice issued under Section 106 of the Act, it would be noticed that the notice issued was dated 27.06.2015 and the tenancy was terminated w.e.f. 30.06.2015 i.e. within three days, however, the suit was filed on 04.08.2015 i.e. after about one month of giving of the notice. The provisions of Section 106 of the Act, inter-alia, provides that a lease of immovable property is terminable on part of either lessor or lessee by 15 days' notice and in case of lease of immovable property for agriculture or manufacturing purposes by six months' notice. However, sub-section (3) of Section 106 of the Act provides that a notice shall not be deemed to be invalid merely because the period mentioned therein falls short of the period specified under sub-section (1), where a suit or proceeding is filed after the expiry of the period mentioned in that sub-section and therefore, if it is found that the lease is for the purpose other than manufacturing purpose merely giving a three days' notice would not invalidate the proceedings.

The appellant himself in his statement has clearly admitted that he was a tenant in the shop since 1976, in the year 1976, his shop was that of cloth in the name of Shankar Cloth Store, he changed his business in the year 1990-91 and started work of dye cutting of jewellery in the name of Mankad Jewellers.

From the above statement,

The various Courts have dealt with the said aspect and have come to the conclusion that

Bombay High Court in the case of Ruprao Nagorao Mahulkar (supra), inter-alia, observed as under :-

"16. I, however, think that

for the purposes of section 106 what is relevant is the purpose for which the lease was obtained at the time when the lease was obtained. A subsequent change of use and subsequent employment of the premises taken on lease for a manufacturing purpose where they were not at the commencement taken for that purpose would not entitle a lessee to take advantage of section 106. The purpose of the lease must be found arid ascertained with reference to the time when the lease was brought into existence. This seems to me also consistent and in accordance with the other provisions of the Transfer of Property Act and law in that behalf. Section 108 (a) of the Transfer of Property Act speaks of rights and liabilities of the lessees. In the absence of a contract of local usage to the contrary, a lessee is under an obligation by virtue of section 108 (a) of the Transfer of Property Act to use the leased premises for the purpose for which they were let and is obliged not to use them "for the purpose other than for which it was leased." To do so therefore, would be a, breach of the terms and conditions of the lease which are implied in the absence of the contract to the contrary. Section 111 (g) of the Transfer of Property Act provides that where a lease permits a re-entry on breach of a condition, then the lessor would be entitled to determine the lease and re- enter. Section 106 of the Transfer of Property Act also provides for termination of leases. A breach of terms and conditions of the lease would entitle a lessor to terminate the lease and to re-enter. In Devji's case (supra) Justice P.B. Mukherjee also observed that "the lease for manufacturing purpose must be a lease which at its inception is for that purpose. The lease at the time of the grant by the landlord must be impressed with the purpose of manufacture." Per contra-where it is not so impressed and where that was not the purpose at the time when the lease was commenced, the lessee would not be entitled to take advantage of section 106 of the Transfer of Property Act."

...........

When addressee refuses to accept registered post, it is presumed due service and knowledge of contents of letter can always be imputed on the addressee

Coming to the issue regarding the alleged non-service of notice under Section 106 of the Act on the appellant, a bare look at the Exhibit-6, which is an undelivered Registered A/D envelop sent to the appellant reveals that the same was sent by the counsel for the plaintiff to the appellant. The appellant in his statement admitted that the address indicated on the envelop was correct. The envelop clearly bears the endorsement made by the postman regarding refusal to receive the article. It is well settled that a notice sent under Section 106 of the Act, if refused by the tenant, the same is a sufficient service of the notice.

Hon'ble Supreme Court in Puwada Venketeswara Rao v. Chidamana Venkata Ramana : AIR 1976 SC 869, observed that

"8. There is presumption of service of a letter sent under registered cover, if the same is returned back with a postal endorsement that the addressee refused to accept the same. No doubt the presumption is rebuttable and it is open to the party concerned to place evidence before the Court to rebut the presumption by showing that the address mentioned on the cover was incorrect or that the postal authorities never tendered the registered letter to him or that there was no occasion for him to refuse the same. The burden to rebut the presumption lies on the Party, challenging the factum of service. In the instant case the respondent failed to discharge this burden as he failed to place material before the Court to show that the endorsement made by the postal authorities was wrong and incorrect. Mere denial made by the respondent in the circumstances of the case was not sufficient to rebut the presumption relating to service of the registered cover.

We are, therefore, of the opinion that the letter dated 24-4-1974 was served on the respondent and he refused to accept the same. Consequently, the service was complete and the view taken by the High Court is incorrect."

Accused can be released on interim bail on the ground of snail speed of the trial

Successive application for bail is permissible under substantial change of circumstances which has direct impact on the earlier decision and not merely cosmetic changes

"19.....However, unintentional and unavoidable delays or administrative factors over which prosecution has no control, such as, over- crowded court dockets, absence of the presiding officers, strike by the lawyers, delay by the superior forum in notifying the designated Judge, (in the present case only), the matter pending before the other forums, including High Courts and Supreme Courts and adjournment of the criminal trial at the instance of the accused, may be a good cause for the failure to complete the trial within a reasonable time. This is only illustrative and not exhaustive. Such delay or delays cannot be violative of accused's right to a speedy trial and needs to be excluded while deciding whether there is unreasonable and unexplained delay..."

28 September 2020

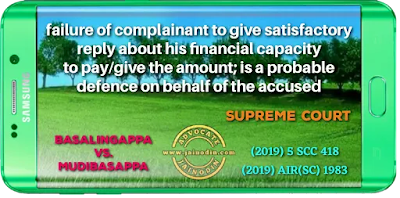

In cheque dishonor case; failure of complainant to give satisfactory reply about his financial capacity to pay/give the amount; is a probable defence on behalf of the accused

27 September 2020

For removal of Sarpach from his post in Maharashtra, enquiry should be conducted by CEO of Z.P. himself and not by enquiry committee directed by him

"Delegatus non potest delegare"

"26]Considering the provisions contained in Section 39(1) of the said Act, and the law on the subject matter discussed hereinabove, it is apparent that the enquiry under Section 39 of the said Act has necessarily to be conducted by the Chief Executive Officer and none else. Such enquiry has to be preceded by necessary order directing the Chief Executive Officer to hold the enquiry and such order should be necessarily issued by the President of the Zilla Parishad. Pursuant to such appointment, the Chief Executive Officer himself has to hear the person against whom the enquiry is to be conducted and based on such enquiry, the Chief Executive Officer has to prepare a report and submit the same to the President of the Zilla Parishad. All these requirements are mandatory in nature and any failure in that regard on the part of the authorities, the proceedings under Section 39(1) of the said Act would be vitiated and any order passed on the basis of such proceedings which are vitiated would be rendered null and void. Reverting to the facts of the case, undisputedly, the order of the removal of the petitioner from the office of Sarpanch was not preceded by any enquiry by the Chief Executive Officer. There was no order of the President appointing the Chief Executive Officer to enquire into the mater."

Since no contrary authority having been cited before me, I find no reason and justification from taking any other view. When it is a matter of taking a drastic action against a Sarpanch and the provision requires inquiry to be conducted by a Chief Executive Officer to whom it is delegated by the Commissioner respondent no.2 he could not have overlooked the fact that instead of the Chief Executive Officer, the inquiry was conducted by a 3 member committee as per the directions of the Chief Executive Officer.

Rules of pleadings do not strictly apply to petition for motor vehicle accident claim because tribunal can also initiate suo motu proceeding whithout there being any pleading

Once the actual occurrence of the accident, has been established, then the Tribunal’s role would be to calculate the quantum of just compensation if the accident had taken place by reason of negligence of the driver of a motor vehicle.

We have no hesitation in observing that such a hyper technical and trivial approach of the High Court cannot be sustained in a case for compensation under the Act, in connection with a motor vehicle accident resulting in the death of a family member. Recently, in Mangla Ram Vs. Oriental Insurance Company Limited and Ors., (to which one of us, Khanwilkar, J. was a party), this Court has restated the position as to the approach to be adopted in accident claim cases. In that case, the Court was dealing with a case of an accident between a motorcycle and a jeep, where the Tribunal had relied upon the FIR and charge sheet, as well as the accompanying statements of the complainant and witnesses, to opine that the police records confirmed the occurrence of an accident and also the identity of the offending jeep but the High Court had overturned that finding inter alia on the ground that the oral evidence supporting such a finding had been discarded by the Tribunal itself and that reliance solely on the document forming part of the police record was insufficient to arrive at such a finding. Disapproving that approach, this Court, after adverting to multitude of cases under the Act, noted as follows:

“22. The question is: Whether this approach of the High Court can be sustained in law? While dealing with a similar situation, this Court in Bimla Devi noted the defence of the driver and conductor of the bus which inter alia was to cast a doubt on the police record indicating that the person standing at the rear side of the bus, suffered head injury when the bus was being reversed without blowing any horn. This Court observed that while dealing with the claim petition in terms of Section 166 of the Motor Vehicles Act, 1988, the Tribunal stricto sensu is not bound by the pleadings of the parties, its function is to determine the amount of fair compensation. In paras 1115, the Court observed thus: (SCC pp. 53334)

“11.

While dealing with a claim petition in terms of Section 166 of the Motor Vehicles Act, 1988, a tribunal stricto sensu is not bound by the pleadings of the parties; its function being to determine the amount of fair compensation in the event an accident has taken place by reason of negligence of that driver of a motor vehicle. It is true that occurrence of an accident having regard to the provisions contained in Section 166 of the Act is a sine qua non for entertaining a claim petition but that would not mean that despite evidence to the effect that death of the claimant’s predecessor had taken place by reason of an accident caused by a motor vehicle, the same would be ignored only on the basis of a postmortem report visàvis the averments made in a claim petition.12. The deceased was a constable. Death took place near a police station. The postmortem report clearly suggests that the deceased died of a brain injury. The place of accident is not far from the police station. It is, therefore, difficult to believe the story of the driver of the bus that he slept in the bus and in the morning found a dead body wrapped in a blanket. If the death of the constable had taken place earlier, it is wholly unlikely that his dead body in a small town like Dharampur would remain undetected throughout the night particularly when it was lying at a busstand and near a police station. In such an event, the Court can presume that the police officers themselves should have taken possession of the dead body.

13. The learned Tribunal, in our opinion, has rightly proceeded on the basis that apparently there was absolutely no reason to falsely implicate Respondents 2 and 3. The claimant was not at the place of occurrence. She, therefore, might not be aware of the details as to how the accident took place but the fact that the first information report had been lodged in relation to an accident could not have been ignored.

14. Some discrepancies in the evidence of the claimant’s witnesses might have occurred but the core question before the Tribunal and consequently before the High Court was as to whether the bus in question was involved in the accident or not. For the purpose of determining the said issue, the Court was required to apply the principle underlying the burden of proof in terms of the provisions of Section 106 of the Evidence Act, 1872 as to whether a dead body wrapped in a blanket had been found at the spot at such an early hour, which was required to be proved by Respondents 2 and 3.

15. In a situation of this nature, the Tribunal has rightly taken a holistic view of the matter. It was necessary to be borne in mind that strict proof of an accident caused by a particular bus in a particular manner may not be possible to be done by the claimants. The claimants were merely to establish their case on the touchstone of preponderance of probability. The standard of proof beyond reasonable doubt could not have been applied. For the said purpose, the High Court should have taken into consideration the respective stories set forth by both the parties.” (emphasis supplied)

The Court restated the legal position that the claimants were merely to establish their case on the touchstone of preponderance of probability and standard of proof beyond reasonable doubt cannot be applied by the Tribunal while dealing with the motor accident cases. Even in that case, the view taken by the High Court to reverse similar findings, recorded by the Tribunal was set aside.

26 September 2020

Delay in filing written statement can not be condoned if defendant found at laxity or gross negligence in filing the same

25 September 2020

Daughter-in-law has no right of residence in the self-acquired property of mother-in-law or father-in-law

While deciding bail application, it cannot be presumed that petitioner will flee justice or will influence the investigation/witnesses

Grant of bail cannot be thwarted merely by asserting that offence is grave.

Consequences of pre-trial detention are grave.

In AIR 2019 SC 5272, titled P. Chidambaram v. Central Bureau of Investigation, CBI had opposed the bail plea on the grounds of:- (i) flight risk; (ii) tampering with evidence; and (iii) influencing witnesses. The first two contentions were rejected by the High Court. But bail was declined on the ground that possibility of influencing the witnesses in the ongoing investigation cannot be ruled out. Hon'ble Apex Court after considering (2001) 4 SCC 280, titled Prahlad Singh Bhati v. NCT, Delhi and another;( 2004) 7 SCC 528, titled Kalyan Chandra sarkar v.R ajesh Ranjan and another; (2005) 2 SCC 13, titled Jayendra Saraswathi Swamigal v. State of Tamil Nadu and (2005) 8 SCC 21, titled State of U.P. through CBI v.Amarmani Tripathi, observed as under:-

"26. As discussed earlier, insofar as the "flight risk" and "tampering with evidence" are concerned, the High Court held in favour of the appellant by holding that the appellant is not a "flight risk" i.e. "no possibility of his abscondence". The High Court rightly held that by issuing certain directions like "surrender of passport", "issuance of look out notice", "flight risk" can be secured. So far as "tampering with evidence" is concerned, the High Court rightly held that the documents relating to the case are in the custody of the prosecuting agency, Government of India and the Court and there is no chance of the appellant tampering with evidence.

28. So far as the allegation of possibility of influencing the witnesses, the High Court referred to the arguments of the learned Solicitor General which is said to have been a part of a "sealed cover" that two material witnesses are alleged to have been approached not to disclose any information regarding the appellant and his son and the High Court observed that the possibility of influencing the witnesses by the appellant cannot be ruled out. The relevant portion of the impugned judgment of the High Court in para (72) reads as under:

"72. As argued by learned Solicitor General, (which is part of 'Sealed Cover', two material witnesses (accused) have been approached for not to disclose any information regarding the petitioner and his son (co-accused). This court cannot dispute the fact that petitioner has been a strong Finance Minister and Home Minister and presently, Member of Indian Parliament. He is respectable member of the Bar Association of Supreme Court of India. He has long standing in BAR as a Senior Advocate. He has deep root in the Indian Society and may be some connection in abroad. But, the fact that he will not influence the witnesses directly or indirectly, cannot be ruled out in view of above facts. Moreover, the investigation is at advance stage, therefore, this Court is not inclined to grant bail."

29. FIR was registered by the CBI on 15.05.2017. The appellant was granted interim protection on 31.05.2018 till 20.08.2019. Till the date, there has been no allegation regarding influencing of any witness by the appellant or his men directly or indirectly. In the number of remand applications, there was no whisper that any material witness has been approached not to disclose information about the appellant and his son. It appears that only at the time of opposing the bail and in the counter affidavit filed by the CBI before the High Court, the averments were made that "....the appellant is trying to influence the witnesses and if enlarged on bail, would further pressurize the witnesses....". CBI has no direct evidence against the appellant regarding the allegation of appellant directly or indirectly influencing the witnesses. As rightly contended by the learned Senior counsel for the appellant, no material particulars were produced before the High Court as to when and how those two material witnesses were approached. There are no details as to the form of approach of those two witnesses either SMS, email, letter or telephonic calls and the persons who have approached the material witnesses. Details are also not available as to when, where and how those witnesses were approached.

31. It is to be pointed out that the respondent - CBI has filed remand applications seeking remand of the appellant on various dates viz. 22.08.2019, 26.08.2019, 30.08.2019, 02.09.2019, 05.09.2019 and 19.09.2019 etc. In these applications, there were no allegations that the appellant was trying to influence the witnesses and that any material witnesses (accused) have been approached not to disclose information about the appellant and his son. In the absence of any contemporaneous materials, no weight could be attached to the allegation that the appellant has been influencing the witnesses by approaching the witnesses. The conclusion of the learned Single Judge "...that it cannot be ruled out that the petitioner will not influence the witnesses directly or indirectly....." is not substantiated by any materials and is only a generalised apprehension and appears to be speculative. Mere averments that the appellant approached the witnesses and the assertion that the appellant would further pressurize the witnesses, without any material basis cannot be the reason to deny regular bail to the appellant; more so, when the appellant has been in custody for nearly two months, co-operated with the investigating agency and the charge sheet is also filed.

32. The appellant is not a "flight risk" and in view of the conditions imposed, there is no possibility of his abscondence from the trial. Statement of the prosecution that the appellant has influenced the witnesses and there is likelihood of his further influencing the witnesses cannot be the ground to deny bail to the appellant particularly, when there is no such whisper in the six remand applications filed by the prosecution. The charge sheet has been filed against the appellant and other co-accused on 18.10.2019. The appellant is in custody from 21.08.2019 for about two months. The co-accused were already granted bail. The appellant is said to be aged 74 years and is also said to be suffering from age related health problems. Considering the above factors and the facts and circumstances of the case, we are of the view that the appellant is entitled to be granted bail."[Para No.5.v.6]

24 September 2020

If charge sheet is not corroborating with the facts stated in the Motor Vehicle Accident Claim Petition, then the Tribunal should not considered the Claim Petition at all

The entire facts and circumstances raises a doubt in the mind of the Court. As far as the accident claims are concerned, the facts must be unambiguous.

22 September 2020

In the name of judicial activism Judges cannot cross their limits

Before parting with this case we would like to make some observations about the limits of the powers of the judiciary. We are compelled to make these observations because we are repeatedly coming across cases where Judges are unjustifiably trying to perform executive or legislative functions. In our opinion this is clearly unconstitutional.

Under our Constitution, the Legislature, Executive and Judiciary all have their own broad spheres of operation. Ordinarily it is not proper for any of these three organs of the State to encroach upon the domain of another, otherwise the delicate balance in the Constitution will be upset, and there will be a reaction.[Para No.19]

20 September 2020

Mere proof of handwriting of a document would not tantamount to proof of all the contents or the facts stated in the document

19 September 2020

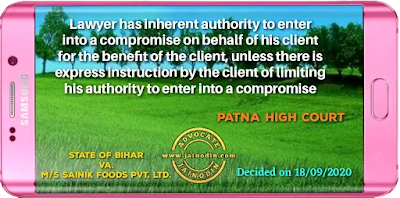

Lawyer has inherent authority to enter into a compromise on behalf and benefit of his client, unless there is express instruction by the client of limiting his authority to enter into a compromise

18 September 2020

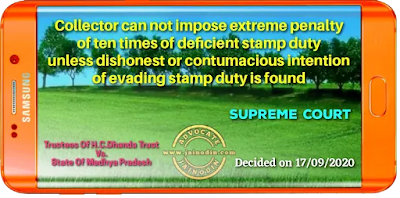

Collector can not impose extreme penalty of ten times of deficient stamp duty unless dishonest or contumacious intention of evading stamp duty is found

“16. Deputy Commissioner under Section 38 is empowered to refund any portion of the penalty in excess of five rupees which has been paid in respect of such instrument. Section 38 Sub-section (1) again uses the expression "if he thinks fit". Thus, in cases where penalty of 10 times has been imposed, Deputy Commissioner has discretion to direct the refund of the penalty in facts of a particular case. The power to refund the penalty Under Section 38 clearly indicates that legislature have never contemplated that in all cases penalty to the extent of 10 times should be ultimately realised. Although the procedural part which provides for impounding and realisation of duty and penalty does not give any discretion Under Section 33 for imposing any lesser penalty than 10 times, however, when provision of Section 38 is read, the discretion given to Deputy Commissioner to refund the penalty is akin to exercise of the jurisdiction Under Section 39 where while determining the penalty he can impose the penalty lesser than 10 times.”[Para No.19]

17 September 2020

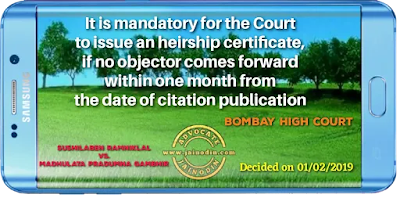

It is mandatory for the Court to issue an heirship certificate, if no objector comes forward within one month from the date of citation publication

Proceeding for heirship certificate can not be suspended till the decision of separate suit for partition filed by the objector

16 September 2020

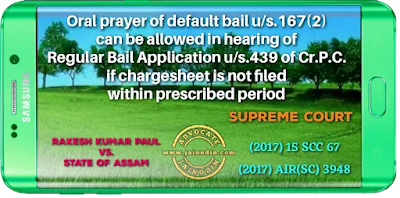

Oral prayer of default bail u/s.167(2) can be allowed in hearing of Regular Bail Application u/s.439 of Cr.P.C. if chargesheet is not filed within prescribed period

Mamalatdar's decision in respect of existence or use of customary way does not operate as res judicata to a suit in civil court on the same issue

22. Subject to the provisions of section 23, sub-section (2), the party in favour of whom the Mamlatdar issues an order for removal of an impediment of the party to whom the Mamlatdar gives possession or restores a use, or in whose favour an injunction is granted, shall continue to have the surface water upon his land flow unimpeded on to adjacent land or continue in possession or use, as the case may be, until otherwise decreed or ordered, or until ousted, by a competent Civil Court :

Provided, firstly, that nothing in this section shall prevent the party against whom the Mamlatdar's decision is passed from recovering by a suit in a competent Civil Court mesne profits for the time he has been kept out of possession of any property or out of enjoyment of any use:

Provided, secondly, that in any subsequent suit or other proceeding in any Civil Court between the same parties, or other persons claiming under them, the Mamlatdar's decision respecting the possession of any property or the enjoyment of any use or respecting the title to or valuation of any crop dealt with under the proviso to sub-section (1) of section 21, shall not be held to be conclusive.[Para No.16]

15 September 2020

Bail cannot be withheld merely as a punishment

When accused surrendered before Sessions court, the court has powers u/s.439 of Cr.P.C. to release accused on personal bond for a short period pending the disposal of a bail application

14 September 2020

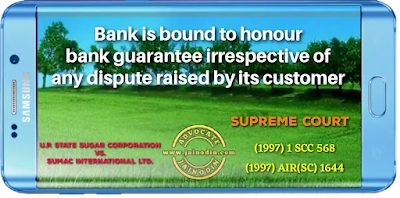

Bank is bound to honour bank guarantee irrespective of any dispute raised by its customer

13 September 2020

A stranger to the suit cannot be impleaded under Order 1 Rule 10 of C.P.C. in a suit for specific performance merely to avoid multiplicity of the suits

Doctrine of lis pendency does not annul the conveyance or the transfer made during the pendency of suit.

Liquidation proceedings are also fixed before the Company Law Board. For impleading a party in a suit for specific performance, two tests are to be satisfied. Firstly, there must be a right to some relief against the plaintiff in respect of suit property. Secondly, that in the absence of the petitioner/proposed defendant, no effective adjudication can be done by the trial Court.