Proceeding for heirship certificate can not be suspended till the decision of separate suit for partition filed by the objector

This writ petition challenges the order dated 18.07.2018 passed by the Civil Judge, Junior Division, Ghatanji, whereby an application filed by the petitioner under Section 2 of the Bombay Regulation Act, 1827 for grant of heirship certificate has been kept suspended, till conclusion of civil suit pending between the parties.[Para No.2]

The petitioner had filed the aforesaid application before the Court below claiming that she was the only wife of deceased Ramniklal Gandecha and that they had no children. On this basis, the petitioner prayed for grant of heirship certificate under the aforesaid provision to be declared the only heir of the said deceased Ramniklal Gandecha.[Para No.3]

In the said proceeding, the respondent no.1, who was the sister of the said deceased Ramniklal Gandecha, filed an objection. In the said objection, it was pointed out that the said objector had filed a civil suit bearing Regular Civil Suit No. 7 of 2016 before the Civil Judge, Junior Division, Ghatanji, being a suit for partition and separate possession, wherein the petitioner, brother and sister of the said objector were defendants. It was contended by the said objector (respondent no.1) that if heirship certificate was granted to the petitioner, she would approach the competent authority for mutation of her name in the house property in which she was residing. It was contended that, according to the objector -respondent no.1, the said house property belonged to her father, in respect of which the aforesaid suit for partition and separate possession had been filed.[Para No.4]

By the impugned order, the Court below has come to the conclusion that when the aforesaid suit for partition and separate possession had been already filed by the respondent no.1(objector), the application filed by the petitioner under Section 2 of the aforesaid Act would have to wait final adjudication of rights of parties in the aforesaid suit. On this basis, the proceedings in the application filed by the petitioner were suspended till the conclusion of the civil suit.[Para No.5]

A perusal of Section 2 of the aforesaid Act and the application filed by the petitioner thereunder shows that the only prayer made by the petitioner is for grant of heirship certificate to declare that she is the only heir of the deceased Ramniklal Gandecha. A perusal of the objection raised on behalf of respondent no.1 shows that the said respondent has admitted the fact that the petitioner was the only wife of the deceased Ramniklal Gandecha and that they had no children. In view of the aforesaid facts, it would be evident that the claim made in the application filed by the petitioner under the provisions of the said Act, even if granted, would not result in recognition of any rights of the petitioner in respect of the said house property and that an application for mutation before the competent authority, if preferred by the petitioner, would be decided as per law after issuance of notice by the competent authority. Grant of heirship certificate would not ipso facto lead to recognition or crystallization of any rights of the petitioner in the house in question. At best, it would assist the petitioner in claiming that she was entitled to the rights that the deceased Ramniklal Gandecha was entitled, as his only heir.[Para No.6]

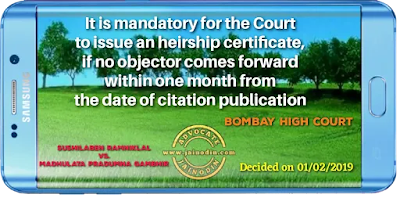

Therefore, apprehension expressed by the objector before the Court in the present proceedings was misconceived. The Court below also erred in suspending the proceeding in the present case only on the ground that the aforesaid suit filed by the respondent no.1 was pending before the said Court. The issues raised in the said suit, filed for partition and separate possession, would certainly be decided on merits by the Court and mere pendency of the aforesaid suit ought not to result in suspension of proceedings in the present case. This is fortified by a decision referred to by the learned counsel appearing for the petitioner in the case of Ganpati Vinayak Achwal - 2015(2) All MR 285 wherein this Court held as follows: