17 July 2021

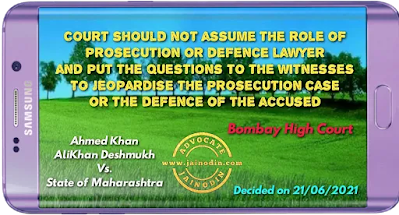

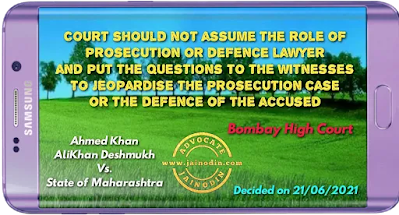

Court should not assume the role of prosecution or defence lawyer and put the questions to the witnesses to jeopardise the prosecution case or the defence of the accused

13 July 2021

For proving the offence of forgery u/s.465 of IPC, it must be proved as to who did it

23 June 2021

voluntary presents given at or before or after the marriage to the bride or the bridegroom, out of love and affection is not dowry

19 June 2021

Continuous and consensual sex between two adults cannot be considered as Rape

15 June 2021

After lapse of previous rent agreement if fresh rent agreement is not created, then the landlord can recover last payable rent but not the enhanced rent

28 May 2021

Misuse and or abuse of powers by public servant is not a part of their official duties so no protection u/s.197 of CrPC is available

If the authority vested in a public servant is misused for doing things which are not otherwise permitted under the law, such acts cannot claim the protection of Section 197 Cr.P.C.

30 April 2021

When counsel reports no instructions, it is the duty of the Court to issue notice to the party concerned before proceeding further in the matter

Every litigant ought to be afforded an opportunity of deciding the issue involved on merits without the same being scuttled on mere technicalities

29 April 2021

Cr.P.C. does not provide any provision for service of summons through Whatsapp

Going by Section 65 of Cr.P.C, if service could not be effected as provided under Section 62, the serving officer shall affix one of the duplicates of the summons to the conspicuous part of the house or homestead in which the person summoned ordinarily resides. Thereafter, the court should make such enquiries as it thinks fit and either declare the summons to have been duly served or order fresh service in such manner as it considers proper. As per Rule 7 of the Criminal Rules of Practice, Kerala, summons issued to the accused and witnesses shall ordinarily be signed by the Chief Ministerial Officer of the Court and the words “By order of the Court” shall invariably be prefixed to the signature of the Ministerial Officer. [Para No.3]

Judicial discretion cannot be so liberally exercised as to condone the delay where no cause is made out or the cause ascribed is unworthy of acceptance

The sufficient cause should be such as it would persuade the Court, in exercise of its judicial discretion, to treat the delay as an excusable one

“32. It must be kept in mind that whenever a law is enacted by the legislature, it is intended to be enforced in its proper perspective. It is an equally settled principle of law that the provisions of a statute, including every word, have to be given full effect, keeping the legislative intent in mind, in order to ensure that the projected object is achieved. In other words, no provisions can be treated to have been enacted purposelessly.Furthermore, it is also a well settled canon of interpretative jurisprudence thatthe Court should not give such an interpretation to the provisions which would render the provision ineffective or odious. Once the legislature has enacted the provisions of Order 22, with particular reference to Rule 9, and the provisions of the Limitation Act are applied to the entertainment of such an application, all these provisions have to be given their true and correct meaning and must be applied wherever called for.If we accept the contention of the Learned Counsel appearing for the applicant that the Court should take a very liberal approach and interpret these provisions (Order 22 Rule 9 CPC and Section 5 of the Limitation Act) in such a manner and so liberally, irrespective of the period of delay, it would amount to practically rendering all these provisions redundant and inoperative. Such approach or interpretation would hardly be permissible in law. 34.Liberal construction of the expression ‘sufficient cause' is intended to advance substantial justice which itself presupposes no negligence or inaction on the part of the applicant, to whom want of bona fide is imputable. There can be instances where the Court should condone the delay; equally there would be cases where the Court must exercise its discretion against the applicant for want of any of these ingredients or where it does not reflect “sufficient cause” as understood in law. (Advanced Law Lexicon, P. Ramanatha Aiyar, 2nd Edition 1997).35. The expression “sufficient cause” implies the presence of legal and adequate reasons. The word “sufficient” means adequate enough, as much as may be necessary to answer the purpose intended. It embraces no more than that which provides a plentitude which, when done, suffices to accomplish the purpose intended in the light of existing circumstances and when viewed from the reasonable standard of practical and cautious men.The sufficient cause should be such as it would persuade the Court, in exercise of its judicial discretion, to treat the delay as an excusable one. These provisions give the Courts enough power and discretion to apply a law in a meaningful manner, while assuring that the purpose of enacting such a law does not stand frustrated.36…………………………………………………………….37…………………………………………………………….38. Above are the principles which should control the exercise of judicial discretion vested in the Court under these provisions. The explained delay should be clearly understood in contradistinction to inordinate unexplained delay.Delay is just one of the ingredients which has to be considered by the Court. In addition to this,the Court must also take into account the conduct of the parties, bona fide reasons for condonation of delay and whether such delay could easily be avoided by the applicant acting with normal care and caution. The statutory provisions mandate that applications for condonation of delay and applications belatedly filed beyond the prescribed period of limitation for bringing the legal representatives on record, should be rejected unless sufficient cause is shown for condonation of delay. The larger benches as well as equi-benches of this Court have consistently followed these principles and have either allowed or declined to condone the delay in filing such applications. Thus, it is the requirement of law that these applications cannot be allowed as a matter of right and even in a routine manner. An applicant must essentially satisfy the above stated ingredients; then alone the Court would be inclined to condone the delay in the filing of such applications.”[Para No.18]

25 April 2021

No contract employee has any vested right to continue or to have his or her contract renewed

6.It is settled law that no contract employee has a right to have his or her contract renewed from time to time. That being so, we are in agreement with the Central Administrative Tribunal and the High Court that the petitioner was unable to show any statutory or other right to have his contract extended beyond 30th June, 2010. At best, the petitioner could claim that the concerned authorities should consider extending his contract. We find that in fact due consideration was given to this and in spite of a favourable recommendation having been made, the All India Institute of Medical Sciences did not find it appropriate or necessary to continue with his services on a contractual basis. We do not find any arbitrariness in the view taken by the concerned authorities and therefore reject this contention of the petitioner.7. We are also in agreement with the view expressed by the Central Administrative Tribunal and the High Court that the petitioner is not entitled to the benefit of the decision of this Court in Uma Devi. There is nothing on record to indicate that the appointment of the petitioner on a contractual basis or on an ad hoc basis was made in accordance with any regular procedure or by following the necessary rules. That being so, no right accrues in favour of the petitioner for regularisation of his services. The decision in Uma Devi does not advance the case of the petitioner.8. Insofar as the final submission of the petitioner to the effect that some persons were appointed as Technical Assistant (ENT) in May 2016 is concerned, we are of the view that the events of 2016 cannot relate back to the events of 2010 when a decision was taken by the All India Institute of Medical Sciences not to extend the contract of the petitioner. The situation appears to have changed over the last six years and the petitioner cannot take any advantage of the changed situation. There is no material on record to indicate what caused the change in circumstances, and merely because there was a change in circumstances, does not mean that the petitioner is entitled to any benefit. On the other hand, it might have been more appropriate for the petitioner to have participated in the walk in interview so that he could also be considered for appointment as Technical Assistant (ENT), but he chose not to do so.

22 April 2021

Non-production/withholding a vital document in order to gain an advantage on the other side tantamounts to playing fraud on the Court

No litigant is entitled to obtain the aid of the law to protect him in carrying out a fraudulent act

11 April 2021

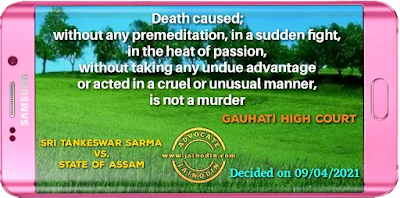

Death caused; without any premeditation, in a sudden fight, in the heat of passion, without taking any undue advantage or acted in a cruel or unusual manner, is not a murder

"19. Consequently, we are convinced thatsince the death of Suraj Mal and Shri Ram had occurred due to the firing resorted to as part of his self-defence, the same would amount to culpable homicide not amounting to murder, which was committed without any premeditation in a sudden fight in the heat of passionupon a sudden quarrel and that the offender did not take undue advantage or acted in a cruel or unusual manner, which would normally fall under Exception 4 of Section 300 IPC. Consequently, at best, conviction of the appellant can only be under Part II of Section 304 IPC for which he could have been inflicted with a punishment of ten years. For the very same reason, the conviction imposed under Section 27 of the Arms Act cannot also be sustained. It is stated that the appellant is suffering the sentence in jail and has so far suffered eleven years. The conviction is modified into one under Section 304 Part II and the sentence already suffered by the appellant is held to be more than sufficient."[Para No.29]

06 April 2021

It is appropriate case for grant of anticipatory bail when F.I.R. is lodged by way of counterblast to an earlier F.I.R lodged/complaint filed by the accused against the informant in near proximity of time

12 March 2021

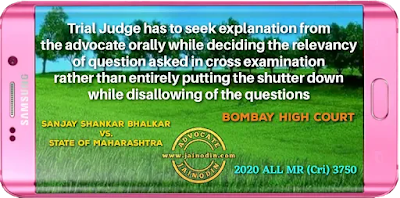

Trial Judge has to seek explanation from the advocate orally while deciding the relevancy of question asked in cross examination rather than entirely putting the shutter down while disallowing of the questions

"No doubtcross-examination is one of the most important processes for the elucidation of the facts of a case and all reasonable latitude should be allowed, but the Judge has always a discretion as to how far it may go or how long it may continue. A fair and reasonable exercise of his discretion by the Judge will not generally be questioned".[Para No.14]

08 March 2021

Judgment in cross/counter cases must be pronounced by the same judge one after the other in the same day

"2. We think that the fair procedure to adopt in a matter like the present where there are cross cases, is to direct thatthe same learned Judge must try both the cross cases one after the other. After the recording of evidence in one case is completed, he must hear the arguments but he must reserve the judgment. Thereafter he must proceed to hear the cross case and after recording all the evidence he must hear the arguments but reserve the judgment in that case. The same learned Judge must thereafter dispose of the matters by two separate judgments. In deciding each of the cases, he can rely only on the evidence recorded in that particular case. The evidence recorded in the cross case cannot be looked into. Nor can the judge be influenced by whatever is argued in the cross case. Each case must be decided on the basis of the evidence which has been placed on record in that particular case without being influenced in any manner by the evidence or arguments urged in the cross case. But both the judgments must be pronounced by the same learned Judge one after the other" [Para No.9]

"12. How to implement the said scheme in a situation where one of the two cases (relating to the same incident) is charge-sheeted or complained of, involves offences or offence exclusively triable by a Court of Sessions, but none of the offences involved in the other case is exclusively triable by the Sessions Court. The Magistrate before whom the former case reaches has no escape from committing the case to the Sessions Court as provided in Section 209 of the Code. Once the said case is committed to the Sessions Court, thereafter it is governed by the provisions subsumed in Chapter XVIII of the Code. Though, the next case cannot be committed in accordance with Section 209 of the Code, the Magistrate has, nevertheless, power to commit the case to the Court of Sessions, albeit none of the offences involved therein is exclusively triable by the Sessions Court. Section 323 is incorporated in the Code to meet similar cases also. That section reads thus:

"323.If, in any inquiry into an offence or a trial before a Magistrate, it appears to him at any stage of the proceedings before signing judgment that the case is one which ought to be tried by the Court of Session, he shall commit it to that Court under the provisions hereinbefore contained and thereupon the provisions of chapter XVIII shall apply to the commitment so made."

14 February 2021

Plaint should contain exact details of the specific date, month, year, etc.of creation of the HUF for the first time; mere statement that HUF exists and property belongs to HUF is not sufficient

"13. Reference on the aspect of HUF can be made to:(i) Neelam Vs. Sada Ram MANU/DE/0322/2013, holding (i) that the Hindu Succession Act, 1956 did away with the concept of ancestral properties as existed prior thereto; after coming into force thereof, the property inherited by a male from his father is held as self-acquired property in which children of such male do not acquire any right by birth; (ii) that the plea of property being a joint family property owing to being jointly owned by members of a family, is not the plea of existence of a coparcenary or HUF; (iii) that HUF and coparcenary are not one and the same under the Hindu law though for the purposes of taxation under the taxation laws are treated as one and the same; (iv) that the law of succession, after coming into force of the Hindu Succession Act is governed thereby only; of course Section 6 thereof carves out an exception qua interest held by the deceased in a Mitakshara coparcenary property and provides that such interest shall devolve by survivorship upon the surviving members of the coparcenary and not in accordance with the Act; (v) however in the absence of any plea of existence of any coparcenary, merely on the plea of the property being of the joint family, no inference of a coparcenary arises; (vi) for a case for claiming a share in the property otherwise than under the Hindu Succession Act, it has to be pleaded that there existed a HUF since prior to the coming into force of the Succession Act and which HUF, by virtue of Section 6 of the Act has been permitted to be continued.(ii) Surender Kumar Vs. Dhani Ram MANU/DE/0126/2016 : AIR 2016 Del 120 holding as under:"5. The Supreme Court around 30 years back in the judgment in the case of Commissioner of Wealth Tax, Kanpur v. Chander Sen, MANU/SC/0265/1986 : (1986) 3 SCC 567, held that after passing of the Hindu Succession Act, 1956 the traditional view that on inheritance of an immovable property from paternal ancestors up to three degrees, automatically an HUF came into existence, no longer remained the legal position in view of Section 8 of the Hindu Succession Act, 1956. This judgment of the Supreme Court in the case of Chander Sen (supra) was thereafter followed by the Supreme Court in the case of Yudhishter v. Ashok Kumar, MANU/SC/0525/1986 : (1987) 1 SCC 204 wherein the Supreme Court reiterated the legal position that after coming into force of Section 8 of the Hindu Succession Act, 1956, inheritance of ancestral property after 1956 does not create an HUF property and inheritance of ancestral property after 1956 therefore does not result in creation of an HUF property.6. In view of the ratios of the judgments in the cases of Chander Sen (supra) and Yudhishter (supra), in law ancestral property can only become an HUF property if inheritance is before 1956, and such HUF property therefore which came into existence before 1956 continues as such even after 1956. In such a case, since an HUF already existed prior to 1956, thereafter, since the same HUF with its properties continues, the status of joint Hindu family/HUF properties continues, and only in such a case, members of such joint Hindu family are coparceners entitling them to a share in the HUF properties.7. On the legal position which emerges pre 1956 i.e. before passing of the Hindu Succession Act, 1956 and post 1956 i.e. after passing of the Hindu Succession Act, 1956, the same has been considered by me recently in the judgment in the case of Sunny (Minor) v. Sh. Raj Singh, CS(OS) No. 431/2006 decided on 17.11.2015. In this judgment, I have referred to and relied upon the ratio of the judgment of the Supreme Court in the case of Yudhishter (supra) and have essentially arrived at the following conclusions:-(i) If a person dies after passing of the Hindu Succession Act, 1956 and there is no HUF existing at the time of the death of such a person, inheritance of an immovable property of such a person by his successors-in-interest is no doubt inheritance of an 'ancestral' property but the inheritance is as a self-acquired property in the hands of the successor and not as an HUF property although the successor(s) indeed inherits 'ancestral' property i.e. a property belonging to his paternal ancestor.(ii) The only way in which a Hindu Undivided Family/joint Hindu family can come into existence after 1956 (and when a joint Hindu family did not exist prior to 1956) is if an individual's property is thrown into a common hotchpotch. Also,once a property is thrown into a common hotchpotch, it is necessary that the exact details of the specific date/month/year etc. of creation of an HUF for the first time by throwing a property into a common hotchpotch have to be clearly pleaded and mentioned and which requirement is a legal requirement because of Order VI Rule 4 CPC which provides that all necessary factual details of the cause of action must be clearly stated. (iii) An HUF can also exist if paternal ancestral properties are inherited prior to 1956, and such status of parties qua the properties has continued after 1956 with respect to properties inherited prior to 1956 from paternal ancestors. Once that status and position continues even after 1956; of the HUF and of its properties existing; a coparcener etc. will have a right to seek partition of the properties.(iv) Even before 1956, an HUF can come into existence even without inheritance of ancestral property from paternal ancestors, as HUF could have been created prior to 1956 by throwing of individual property into a common hotchpotch. If such an HUF continues even after 1956, then in such a case a coparcener etc. of an HUF was entitled to partition of the HUF property.9. I would like to further note that it is not enough to aver a mantra, so to say, in the plaint simply that a joint Hindu family or HUF exists.Detailed facts as required by Order VI Rule 4 CPC as to when and how the HUF properties have become HUF properties must be clearly and categorically averred. Such averments have to be made by factual references qua each property claimed to be an HUF property as to how the same is an HUF property, and, in law generally bringing in any and every property as HUF property is incorrect as there is known tendency of litigants to include unnecessarily many properties as HUF properties, and which is done for less than honest motives. Whereas prior to passing of the Hindu Succession Act, 1956 there was a presumption as to the existence of an HUF and its properties, but after passing of the Hindu Succession Act, 1956 in view of the ratios of the judgments of the Supreme Court in the cases of Chander Sen (supra) and Yudhishter (supra)there is no such presumption that inheritance of ancestral property creates an HUF, and therefore, in such a post 1956 scenarioa mere ipse dixit statement in the plaint that an HUF and its properties exist is not a sufficient compliance of the legal requirement of creation or existence of HUF properties inasmuch as it is necessary for existence of an HUF and its properties that it must be specifically stated that as to whether the HUF came into existence before 1956 or after 1956 and if so how and in what manner giving all requisite factual details. It is only in such circumstances where specific facts are mentioned to clearly plead a cause of action of existence of an HUF and its properties, can a suit then be filed and maintained by a person claiming to be a coparcener for partition of the HUF properties.

07 February 2021

Falsely implicating husband and his family in domestic violence case with intention to ensure that the parties were sent to counselling in order to settle their disputes amounts to mental cruelty entitling husband to seek divorce

Allegations of cruelty in divorce case should be specifically challenged in cross examination

"4. The only point urged albeit strenuously on behalf of the appellant by Mr P.S. Mishra, the learned Senior Counsel is that as there has been no valid service of notice, so all proceedings taken on the assumption of service of notice are illegal and void. He has invited our attention to the judgment of the learned Rent Control Tribunal wherein it is recorded that Exhibit AW 1/6 dated 5-8-1986 was sent by registered post and the same was taken by the postman to the address of the tenant on 6-8-1986, 8-8-1986, 19-8-1986 and 20-8-1986 but on those days the tenant was not available; on 21-8-1986, he met the tenant who refused to receive the notice. This finding remained undisturbed by both the Tribunals as well as the High Court. Learned counsel attacks this finding on the ground that the postman was on leave on those days and submits that the records called for from the post office to prove that fact, were reported as not available. On those facts, submits the learned counsel, it follows that there was no refusal by the tenant and no service of notice. We are afraid we cannot accept these contentions of the learned counsel. In the Court of the Rent Controller, the postman was examined as AW 2. We have gone through his cross-examination. It was not suggested to him that he was not on duty during the period in question and the endorsement "refused" on the envelope was incorrect. In the absence of cross-examination of the postman on this crucial aspect, his statement in the chief examination has been rightly relied upon.There is an age-old rule that if you dispute the correctness of the statement of a witness you must give him opportunity to explain his statement by drawing his attention to that part of it which is objected to as untrue, otherwise you cannot impeach his credit. In State of U.P. v. Nahar Singh (1998) 3 SCC, a Bench of this Court (to which I was a party) stated the principle that Section 138 of the Evidence Act confers a valuable right to cross-examine a witness tendered in evidence by the opposite party. The scope of that provision is enlarged by Section 146 of Evidence Act by permitting a witness to be questioned, inter alia, to test his veracity. It was observed: (SCC p. 567, para 14) "14. The oft-quoted observation of Lord Herschell, L.C. in Browne v. Dunn [(1893) 6 R 67 (HL)] clearly elucidates the principle underlying those provisions. It reads thus:'I cannot help saying, that it seems to me to be absolutely essential to the proper conduct of a cause,where it is intended to suggest that a witness is not speaking the truth on a particular point, to direct his attention to the fact by some questions put in cross-examination showing that that imputation is intended to be made, and not to take his evidence and pass it by as a matter altogether unchallenged, and then, when it is impossible for him to explain, as perhaps he might have been able to do if such questions had been put to him, the circumstances which, it is suggested, indicate that the story he tells ought not to be believed, to argue that he is a witness unworthy of credit. My Lords, I have always understood that if you intend to impeach a witness, you are bound, whilst he is in the box, to give an opportunity of making any explanation which is open to him; and, as it seems to me, that is not only a rule of professional practice in the conduct of a case, but it is essential to fair play and fair dealing with witnesses.' (emphasis supplied)[Para No.11]

"14. Thus, to the instances illustrative of mental cruelty noted in Samar Ghosh, we could add a few more.Making unfounded indecent defamatory allegations against the spouse or his or her relatives in the pleadings, filing of complaints or issuing notices or news items which may have adverse impact on the business prospect or the job of the spouse and filing repeated false complaints and cases in the court against the spouse would, in the facts of a case, amount to causing mental cruelty to the other spouse.

30 January 2021

Provisions of RTI Act are not meant to allow the parties to collect evidence from Public Authorities to subserve their private interest

24 January 2021

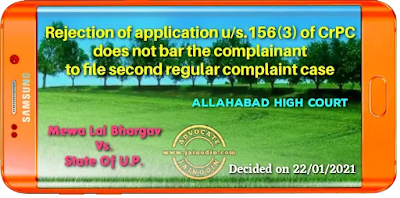

Rejection of application u/s.156(3) of CrPC does not bar the complainant to file second regular complaint case

14 January 2021

Litigants who, with an intent to deceive and mislead the Courts, initiate proceedings without full disclosure of facts, is not entitled to any relief, interim or final

"In the last 40 years, a new creed of litigants has cropped up. Those who belong to this creed do not have any respect for truth. They shamelessly resort to falsehood and unethical means for achieving their goals. In order to meet the challenge posed by this new creed of litigants, the courts have, from time to time, evolved new rules and it is now well established thata litigant, who attempts to pollute the stream of justice or who touches the pure fountain of justice with tainted hands, is not entitled to any relief, interim or final". [Page No.9]