The finding by both the learned Courts below on issue no.3 has been taken up for examination. In this regard, at the outset it must be seen that how far the Agreement for House Rent dated 29.02.2000 (Ext.3, also marked as Ext.D) can be read to determine the quantum of monthly rent for which the petitioner and proforma respondent no.2 had committed default, if there be any. In this regard, as per the provisions of Section 17(d) of the Registration Act, 1908 it is provided that leases of immovable property from year to year, or for any term exceeding one year, or reserving a yearly rent is required to be compulsorily registered. The consequences of non registration is prescribed in Section 49(c) of the said Act, which provides that no document required by section 17 or by any provision of the Transfer of Property Act, 1882 to be registered shall be received as evidence of any transaction affecting such property or conferring such power, unless it has been registered. However, as per the proviso appended thereto, such document may be received as evidence of any collateral transaction not required to be effected by registered instrument. Therefore, when both the Courts below were examining the issue of rent payable after 01.03.2003, there was no written agreement in existence commencing from 01.03.2003. However, the rent payable during the tenure of the agreement was the purpose of agreement, as such, for the purpose of the quantum of therent payable for the period commencing from 01.03.2003 onwards, the said rent agreement (Ext.3, also exhibited as Ext.D) cannot be read in evidence. After 28.02.2003, the petitioner and respondent no.2 were holding the status of statutory tenant. In view of the discussions above, the evidence to the effect that as per the terms of Ext.3/Ext.D, the rent last payable under the said agreement was Rs.2,640/- per month. [Para No.22]

Showing posts with label registration. Show all posts

Showing posts with label registration. Show all posts

15 June 2021

28 February 2021

Deed of gift/hiba executed by a Mohammadan need not required to be registered

The position is well settled, which has been stated and restated time and again, that the three essentials of a gift under Mohammadan Law are; (i) declaration of the gift by the donor; (2) acceptance of the gift by the donee and (3) delivery of possession. Though, the rules of Mohammadan Law do not make writing essential to the validity of a gift; an oral gift fulfilling all the three essentials make the gift complete and irrevocable. However, the donor may record the transaction of gift in writing. Asaf A. A. Fyzee in Outlines of Muhammadan Law, Fifth Edition (edited and revised by Tahir Mahmood) at page 182 states in this regard that writing may be of two kinds : (i) it may merely recite the fact of a prior gift; such a writing need not be registered. On the other hand, (ii) it may itself be the instrument of gift;such a writing in certain circumstances requires registration. He further says that if there is a declaration, acceptance and delivery of possession coupled with the formal instrument of a gift, it must be registered. Conversely, the author says that registration, however, by itself without the other necessary conditions, is not sufficient.[Para No.27]

Mulla, Principles of Mahomedan Law (19th Edition), Page 120, states the legal position in the following words :

"Under the Mahomedan law the three essential requisites to make a gift valid : (1) declaration of the gift by the donor: (2) acceptance of the gift by the donee expressly or impliedly and (3) delivery of possession to and taking possession thereof by the donee actually or constructively.No written document is required in such a case. Section 129 Transfer of Property Act, excludes the rule of Mahomedan law from the purview of Section 123 which mandates that the gift of immovable property must be effected by a registered instrument as stated therein. But it cannot be taken as a sine qua non in all cases that whenever there is a writing about a Mahomedan gift of immovable property there must be registration thereof. Whether the writing requires registration or not depends on the facts and circumstances of each case."[Para No.28]

21 January 2021

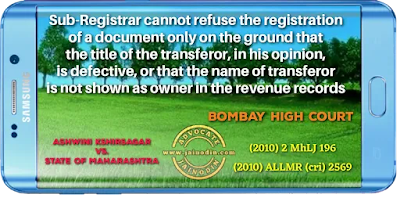

Sub-Registrar cannot refuse registration of document only on the ground that the title of the transferor, in his opinion, is defective

Learned APP submitted that the 7/12 extracts of the lands which were transferred showed the words "Akari Pad" in the occupant's column which indicate that the lands belonged to the government. Sub-Registrar ought to have verified the 7/12 extracts (revenue records) and should have refused the registration of the sale deeds. Selling the government lands amounted to a fraud on the government and by registering the sale deeds without verification of revenue records the applicant has committed an offence. It is settled principle of law that entries in the revenue records (7/12 extracts in case of agricultural lands and property register cards in case of urban lands) are made for fiscal purposes. They do not confer nor take away the title. Entries in the 7/12 extracts, though may have some presumptive value under the Maharashtra Land Revenue Code, are not by themselves proof of title nor do they confer title. Therefore, the mere fact that the properties were shown as "Akari Pad" that by itself was not the proof that the government was the owner of the lands. Even assuming that the government was the owner of the lands, as I have already indicated earlier section 34 of the Act does not require nor does it empower the Sub-Registrar to enquire into the title and to satisfy himself about the title of the transferor. Under the Act the Sub-Registrar is not required, nay not entitled, to ask the transferor to produce 7/12 extracts, property register extract or the like showing the transferor to be the owner of the property. If he refuses registration of a document on the ground that the revenue records do not show the name of the transferor as the owner he would be exceeding his powers under the Act. If all other requirements of registration prescribed by the Act and the Rules are complied with, the Sub-Registrar cannot refuse the registration of a document only on the ground that the title of the transferor, in his opinion, is defective, or that the name of transferor is not shown as owner in the revenue records. [Para No.5]

09 October 2020

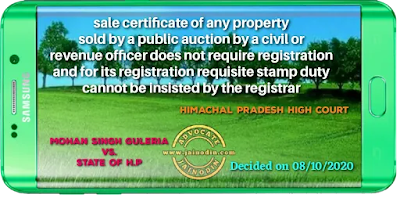

sale certificate of any property sold by a public auction by a civil or revenue officer does not require registration and for its registration requisite stamp duty cannot be insisted by the registrar

Even the aforesaid Section though mandatory in nature provides which of the documents are compulsorily to be registered, but it does not include sale by auction and sale certificate issued by the concerned authority including confirmation of the sale which are outcome of auction proceedings conducted in terms of the Court's order. The provision is speaking one and without any ambiguity, thus, registration was not required.[Para No.8]

The issue raised in this petition is no longer res integra and is squarely covered by the judgment of the Hon'ble Supreme Court in Som Dev and others vs. Rati Ram and another (2006) 10 SCC 788 and thereafter in a subsequent judgment B. Arvind Kumar vs. Govt. of India and others (2007) 5 SCC 745 which judgments, in turn, have been considered by learned Division Bench of this Court in Valley Iron & Steel Company Ltd. vs. State of Himachal Pradesh and other (2016) 5 ILR 1639, and the relevant observations are as under:-

"24. Learned Senior Counsel appearing on behalf of the writ petitioner argued that the authorities concerned have refused to register the sale and make the entries in the revenue records on the ground that the necessary permission was to be obtained as per the mandate of Section 118 of the Act.25. It is also contended that the sale certificate and the confirmation of sale issued by the authorities, i.e. Annexures P6 and P8, are necessary to be registered before the authority concerned in terms of the mandate of Section 17 of the Registration Act, 1908 (for short "the Registration Act"), which is not legally correct.

26.Section 17 of the Registration Act, though mandatory in nature, provides which of the documents are compulsory to be registered. It does not include sale by auction and sale certificate issued by the concerned authorities including confirmation of sale, which are outcome of the auction proceedings conducted in terms of Court orders. The provision is speaking one and without any ambiguity.Thus, registration was not required. The Apex Court in the case titled as B. Arvind Kumar versus Govt. of India and others, 2007 5 SCC 745 , held thata sale certificate issued by a Court or an officer authorized by the Court does not require registration. It is apt to reproduce para 12 of the judgment herein:

"12. The plaintiff has produced the original registered sale certificate dated 29.8.1941 executed by the Official Receiver, Civil Station, Bangalore. The said deed certifies that Bhowrilal (father of plaintiff) was the highest bidder at an auction sale held on 22.8.1941, in respect of the right, title, interest of the insolvent Anraj Sankla, namely the leasehold right in the property described in the schedule to the certificate (suit property), that his bid of Rs. 8,350.00 was accepted and the sale was confirmed by the District Judge, Civil and Military Station, Bangalore on 25.8.1941. The sale certificate declared Bhowrilal to be the owner of the leasehold right in respect of the suit property. When a property is sold by public auction in pursuance of an order of the court and the bid is accepted and the sale is confirmed by the court in favour of the purchaser, the sale becomes absolute and the title vests in the purchaser. A sale certificate is issued to the purchaser only when the sale becomes absolute. The sale certificate is merely the evidence of such title. It is well settled thatwhen an auction purchaser derives title on confirmation of sale in his favour, and a sale certificate is issued evidencing such sale and title, no further deed of transfer from the court is contemplated or required. In this case,the sale certificate itself was registered, though such a sale certificate issued by a court or an officer authorized by the court, does not require registration. Section 17(2)(xii) of the Registration Act, 1908 specifically provides thata certificate of sale granted to any purchaser of any property sold by a public auction by a civil or revenue officer does not fall under the category of non testamentary documents which require registration under subsec. (b) and (c) of sec. 17(1) of the said Act. We therefore hold that the High Court committed a serious error in holding that the sale certificate did not convey any right, title or interest to plaintiff's father for want of a registered deed of transfer."

28. The same principle has been laid down by the Apex Court in the case titled as Som Dev and others versus Rati Ram and another, 2006 10 SCC 788 . It would be profitable to reproduce para 15 of the judgment herein:

"15. Almost the whole of the argument on behalf of the appellants here, is based on the ratio of the decision of this Court in Bhoop Singh v. Ram Singh Major, 1995 5 SCC 709 , It was held in that case that exception under clause (vi) of Section 17(2) of the Act is meant to cover that decree or order of a Court including the decree or order expressed to be made on a compromise which declares the preexisting right and does not by itself create new right, title or interest in praesent in immovable property of the value of Rs.100/ or upwards. Any other view would find the mischief of avoidance of registration which requires payment of stamp duty embedded in the decree or order. It would, therefore, be the duty of the Court to examine in each case whether the parties had preexisting right to the immovable property or whether under the order or decree of the Court one party having right, title or interest therein agreed or suffered to extinguish the same and created a right in praesenti in immovable property of the value of Rs.100/ or upwards in favour of the other party for the first time either by compromise or pretended consent. If latter be the position, the document is compulsorily registrable. Their Lordships referred to the decisions of this Court in regard to the family arrangements and whether such family arrangements require to be compulsorily registered and also the decision relating to an award. With respect, we may point out that an award does not come within the exception contained in clause (vi) of Section 17(2) of the Registration act and the exception therein is confined to decrees or orders of a Court. Understood in the context of the decision in Hemanta Kumari Debi v. Midnapur Zamindari Co. Ltd., 1919 AIR(PC) 79 and the subsequent amendment brought about in the provision, the position that emerges is thata decree or order of a court is exempted from registration even if clauses (b)and (c) of Section 17(1) of the Registration Act are attracted, and even a compromise decree comes under the exception, unless, of course, it takes in any immovable property that is not the subject matter of the suit.

29. A question arose before the Madras High Court in a case titled as K. Chidambara Manickam versus Shakeena & Ors., 2008 AIR(Mad) 108 , whether the sale of secured assets in public auction which ended in issuance of a sale certificate is a complete and absolute sale or whether the sale would become final only on the registration of the sale certificate? It has been held that the sale becomes final when it is confirmed in favour of the auction purchaser, he is vested with rights in relation to the property purchased in auction on issuance of the sale certificate and becomes the absolute owner of the property. The sale certificate does not require any registration. It is apt to reproduce paras 10.13, 10.14, 10.17 and 10.18 of the judgment herein:-

"10.13 Part III of the Registration Act speaks of the Registration of documents. Section 17(1) of the Registration Act enumerates the documents which require compulsory Registration. However, subsection (2) of Section 10 sets out the documents to which clause (b) and (c) of subsection (1) of Section 17 do not apply. Clause (xii) of subsection (2) of Section 17 of the Registration Act reads as under:"Section 17(2)(xii) any certificate of sale granted to the purchaser of any property sold by public auction by a Civil or Revenue Officer."

10.14 A Division Bench of this Court in Arumugham, S. v. C.K. Venugopal Chetty,1994 1 LW 491 , held that the property transferred by Official Assignee, under order of Court, does not require registration under Section 17 of the Registration Act. The Division Bench has held as follows:

02 October 2020

Oral evidence can be given about any fact which would invalidate or contradict the proved or registered document

In respect of registered document (Exh.35), learned Counsel for the appellant has submitted that it is a registered document and therefore, contents therein cannot be contradicted. Sections 91 and 92 of the Indian Evidence Act are material sections in respect of oral evidence of the documents reduced into writing. If the document is proved as per Section 91, then oral evidence as per Section 92 is not permitted to contradict the document but proviso (1) of Section 92 permits to contradict the document. It reads as under :

92.Exclusion of evidence of oral agreement.-When the terms of any such contract, grant or other disposition of property, or any matter required by law to be reduced to the form of a document, have been proved according to the last section, no evidence of any oral agreement or statement shall be admitted, as between the parties to any such instrument or their representatives in interest, for the purpose of contradicting, varying, adding to, or subtracting from, its terms:

Proviso (1). - Any fact may be proved which would invalidate any document, or which would entitle any person to any decree or order relating thereto; such as fraud, intimidation, illegality, want of due execution, want of capacity in any contracting party, [want or failure] of consideration, or mistake in fact or law.[Para No.16]

01 August 2020

Oral family-settlement and its memorandum does not require registration

Be that as it may, the High Court has clearly misapplied the dictum in the relied upon decisions. The settled legal position is that when by virtue of a family settlement or arrangement, members of a family descending from a common ancestor or a near relation seek to sink their differences and disputes, settle and resolve their conflicting claims or disputed titles once and for all in order to buy peace of mind and bring about complete harmony and goodwill in the family, such arrangement ought to be governed by a special equity peculiar to them and would be enforced if honestly made. The object of such arrangement is to protect the family from long drawn litigation or perpetual strives which mar the unity and solidarity of the family and create hatred and bad blood between the various members of the family, as observed in Kale (supra). In the said reported decision, a threeJudge Bench of this Court had observed thus: “9. ….. A family arrangement by which the property is equitably divided between the various contenders so as to achieve an equal distribution of wealth instead of concentrating the same in the hands of a few is undoubtedly a milestone in the administration of social justice. That is why the term “family” has to be understood in a wider sense so as to include within its fold not only close relations or legal heirs but even those persons who may have some sort of antecedent title, a semblance of a claim or even if they have a spes successionis so that future disputes are sealed for ever and the family instead of fighting claims inter se and wasting time, money and energy on such fruitless or futile litigation is able to devote its attention to more constructive work in the larger interest of the country. The courts have, therefore, leaned in favour of upholding a family arrangement instead of disturbing the same on technical or trivial grounds. Where the courts find that the family arrangement suffers from a legal lacuna or a formal defect the rule of estoppel is pressed into service and is applied to shut out plea of the person who being a party to family arrangement seeks to unsettle a settled dispute and claims to revoke the family arrangement under which he has himself enjoyed some material benefits. …..” (emphasis supplied) In paragraph 10 of the said decision, the Court has delineated the contours of essentials of a family settlement as follows: “10. In other words to put the binding effect and the essentials of a family settlement in a concretised form, the matter may be reduced into the form of the following propositions:

“(1) The family settlement must be a bona fide one so as to resolve family disputes and rival claims by a fair and equitable division or allotment of properties between the various members of the family;

(2) The said settlement must be voluntary and should not be induced by fraud, coercion or undue influence;

(3) The family arrangement may be even oral in which case no registration is necessary;

(4) It is well settled that registration would be necessary only if the terms of the family arrangement are reduced into writing. Here also,a distinction should be made between a document containing the terms and recitals of a family arrangement made under the document and a mere memorandum prepared after the family arrangement had already been made either for the purpose of the record or for information of the court for making necessary mutation. In such a case the memorandum itself does not create or extinguish any rights in immovable properties and therefore does not fall within the mischief of Section 17(2) of the Registration Act and is, therefore, not compulsorily registrable;

(5) The members who may be parties to the family arrangement must have some antecedent title, claim or interest even a possible claim in the property which is acknowledged by the parties to the settlement. Even if one of the parties to the settlement has no title but under the arrangement the other party relinquishes all its claims or titles in favour of such a person and acknowledges him to be the sole owner, then the antecedent title must be assumed and the family arrangement will be upheld and the courts will find no difficulty in giving assent to the same;

(6) Even if bona fide disputes, present or possible, which may not involve legal claims are settled by a bona fide family arrangement which is fair and equitable the family arrangement is final and binding on the parties to the settlement.” (emphasis supplied) Again, in paragraph 24, this Court restated that a family arrangement being binding on the parties, clearly operates as an estoppel, so as to preclude any of the parties who have taken advantage under the agreement from revoking or challenging the same. In paragraph 35, the Court noted as follows: “35. … We have already pointed out that this Court has widened the concept of an antecedent title by holding that an antecedent title would be assumed in a person who may not have any title but who has been allotted a particular property by other party to the family arrangement by relinquishing his claim in favour of such a donee. In such a case the party in whose favour the relinquishment is made would be assumed to have an antecedent title. …..” And again, in paragraph 36, the Court noted as follows: “36. … Yet having regard to the near relationship which the brother and the soninlaw bore to the widow the Privy Council held that the family settlement by which the properties were divided between these three parties was a valid one. In the instant case also putting the case of Respondents Nos. 4 and 5 at the highest, the position is that Lachman died leaving a grandson and two daughters. Assuming that the grandson had no legal title, so long as the daughters were there, still as the settlement was made to end the disputes and to benefit all the near relations of the family, it would be sustained as a valid and binding family settlement. …” While rejecting the argument regarding inapplicability of principle of estoppel, the Court observed as follows: “38. … Assuming, however, that the said document was compulsorily registrable the courts have generally held that a family arrangement being binding on the parties to it would operate as an estoppel by preventing the parties after having taken advantage under the arrangement to resile from the same or try to revoke it. …..” (emphasis supplied) And in paragraph 42, the Court observed as follows:

Subscribe to:

Comments (Atom)