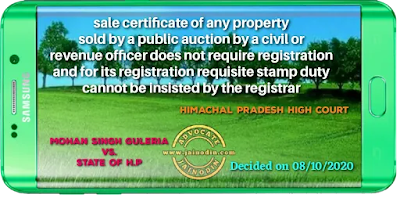

Even the aforesaid Section though mandatory in nature provides which of the documents are compulsorily to be registered, but it does not include sale by auction and sale certificate issued by the concerned authority including confirmation of the sale which are outcome of auction proceedings conducted in terms of the Court's order. The provision is speaking one and without any ambiguity, thus, registration was not required.[Para No.8]

The issue raised in this petition is no longer res integra and is squarely covered by the judgment of the Hon'ble Supreme Court in Som Dev and others vs. Rati Ram and another (2006) 10 SCC 788 and thereafter in a subsequent judgment B. Arvind Kumar vs. Govt. of India and others (2007) 5 SCC 745 which judgments, in turn, have been considered by learned Division Bench of this Court in Valley Iron & Steel Company Ltd. vs. State of Himachal Pradesh and other (2016) 5 ILR 1639, and the relevant observations are as under:-

"24. Learned Senior Counsel appearing on behalf of the writ petitioner argued that the authorities concerned have refused to register the sale and make the entries in the revenue records on the ground that the necessary permission was to be obtained as per the mandate of Section 118 of the Act.25. It is also contended that the sale certificate and the confirmation of sale issued by the authorities, i.e. Annexures P6 and P8, are necessary to be registered before the authority concerned in terms of the mandate of Section 17 of the Registration Act, 1908 (for short "the Registration Act"), which is not legally correct.

26.Section 17 of the Registration Act, though mandatory in nature, provides which of the documents are compulsory to be registered. It does not include sale by auction and sale certificate issued by the concerned authorities including confirmation of sale, which are outcome of the auction proceedings conducted in terms of Court orders. The provision is speaking one and without any ambiguity.Thus, registration was not required. The Apex Court in the case titled as B. Arvind Kumar versus Govt. of India and others, 2007 5 SCC 745 , held thata sale certificate issued by a Court or an officer authorized by the Court does not require registration. It is apt to reproduce para 12 of the judgment herein:

"12. The plaintiff has produced the original registered sale certificate dated 29.8.1941 executed by the Official Receiver, Civil Station, Bangalore. The said deed certifies that Bhowrilal (father of plaintiff) was the highest bidder at an auction sale held on 22.8.1941, in respect of the right, title, interest of the insolvent Anraj Sankla, namely the leasehold right in the property described in the schedule to the certificate (suit property), that his bid of Rs. 8,350.00 was accepted and the sale was confirmed by the District Judge, Civil and Military Station, Bangalore on 25.8.1941. The sale certificate declared Bhowrilal to be the owner of the leasehold right in respect of the suit property. When a property is sold by public auction in pursuance of an order of the court and the bid is accepted and the sale is confirmed by the court in favour of the purchaser, the sale becomes absolute and the title vests in the purchaser. A sale certificate is issued to the purchaser only when the sale becomes absolute. The sale certificate is merely the evidence of such title. It is well settled thatwhen an auction purchaser derives title on confirmation of sale in his favour, and a sale certificate is issued evidencing such sale and title, no further deed of transfer from the court is contemplated or required. In this case,the sale certificate itself was registered, though such a sale certificate issued by a court or an officer authorized by the court, does not require registration. Section 17(2)(xii) of the Registration Act, 1908 specifically provides thata certificate of sale granted to any purchaser of any property sold by a public auction by a civil or revenue officer does not fall under the category of non testamentary documents which require registration under subsec. (b) and (c) of sec. 17(1) of the said Act. We therefore hold that the High Court committed a serious error in holding that the sale certificate did not convey any right, title or interest to plaintiff's father for want of a registered deed of transfer."

28. The same principle has been laid down by the Apex Court in the case titled as Som Dev and others versus Rati Ram and another, 2006 10 SCC 788 . It would be profitable to reproduce para 15 of the judgment herein:

"15. Almost the whole of the argument on behalf of the appellants here, is based on the ratio of the decision of this Court in Bhoop Singh v. Ram Singh Major, 1995 5 SCC 709 , It was held in that case that exception under clause (vi) of Section 17(2) of the Act is meant to cover that decree or order of a Court including the decree or order expressed to be made on a compromise which declares the preexisting right and does not by itself create new right, title or interest in praesent in immovable property of the value of Rs.100/ or upwards. Any other view would find the mischief of avoidance of registration which requires payment of stamp duty embedded in the decree or order. It would, therefore, be the duty of the Court to examine in each case whether the parties had preexisting right to the immovable property or whether under the order or decree of the Court one party having right, title or interest therein agreed or suffered to extinguish the same and created a right in praesenti in immovable property of the value of Rs.100/ or upwards in favour of the other party for the first time either by compromise or pretended consent. If latter be the position, the document is compulsorily registrable. Their Lordships referred to the decisions of this Court in regard to the family arrangements and whether such family arrangements require to be compulsorily registered and also the decision relating to an award. With respect, we may point out that an award does not come within the exception contained in clause (vi) of Section 17(2) of the Registration act and the exception therein is confined to decrees or orders of a Court. Understood in the context of the decision in Hemanta Kumari Debi v. Midnapur Zamindari Co. Ltd., 1919 AIR(PC) 79 and the subsequent amendment brought about in the provision, the position that emerges is thata decree or order of a court is exempted from registration even if clauses (b)and (c) of Section 17(1) of the Registration Act are attracted, and even a compromise decree comes under the exception, unless, of course, it takes in any immovable property that is not the subject matter of the suit.

29. A question arose before the Madras High Court in a case titled as K. Chidambara Manickam versus Shakeena & Ors., 2008 AIR(Mad) 108 , whether the sale of secured assets in public auction which ended in issuance of a sale certificate is a complete and absolute sale or whether the sale would become final only on the registration of the sale certificate? It has been held that the sale becomes final when it is confirmed in favour of the auction purchaser, he is vested with rights in relation to the property purchased in auction on issuance of the sale certificate and becomes the absolute owner of the property. The sale certificate does not require any registration. It is apt to reproduce paras 10.13, 10.14, 10.17 and 10.18 of the judgment herein:-

"10.13 Part III of the Registration Act speaks of the Registration of documents. Section 17(1) of the Registration Act enumerates the documents which require compulsory Registration. However, subsection (2) of Section 10 sets out the documents to which clause (b) and (c) of subsection (1) of Section 17 do not apply. Clause (xii) of subsection (2) of Section 17 of the Registration Act reads as under:"Section 17(2)(xii) any certificate of sale granted to the purchaser of any property sold by public auction by a Civil or Revenue Officer."

10.14 A Division Bench of this Court in Arumugham, S. v. C.K. Venugopal Chetty,1994 1 LW 491 , held that the property transferred by Official Assignee, under order of Court, does not require registration under Section 17 of the Registration Act. The Division Bench has held as follows: