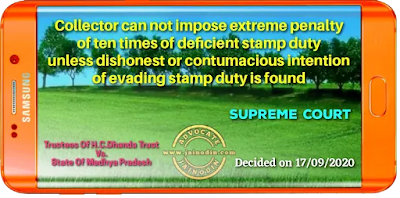

According to Section 40(1)(b) if the Collector is of opinion that such instrument is chargeable with duty and is not duly stamped, he shall require the payment of the of the proper duty or the amount required to make up the same, together with a penalty of the five rupees; or, if he thinks fit, an amount not exceeding ten times the amount of the proper duty or of the deficient portion thereof. The statutory scheme of Section 40(1)(b) as noticed above indicates that when the Collector is satisfied that instrument is not duly stamped, he shall require the payment of proper duty together with a penalty of the five rupees. The relevant part of Section 40(1)(b) which falls for consideration in these appeals is: “or, if he thinks fit, an amount not exceeding ten times the amount of the proper duty or deficient portion thereof.”[Para No.16]

The amount of penalty thus can be an amount not exceeding ten times. The expression “an amount not exceeding ten times” is preceded by expression “if he thinks fit”. The statutory scheme, thus, vest the discretion to the Collector to impose the penalty amount not exceeding ten times. Whenever statute transfers discretion to an authority the discretion is to be exercised in furtherance of objects of the enactment. The discretion is to be exercised not on whims or fancies rather the discretion is to be exercised on rational basis in a fair manner. The amount of penalty not exceeding ten times is not an amount to be imposed as a matter of force. Neither imposition of penalty of ten times under Section 40(1)(b) is automatic nor can be mechanically imposed. The concept of imposition of penalty of ten times of a sum equal to ten times of the proper duty or deficiency thereof has occurred in other provisions of the Act as well. We may refer to Section 35(a) in this context is as follows:

“35. Instruments not duly stamped inadmissible in evidence, etc. — No instrument chargeable with duty shall be admitted in evidence for any purpose by any person having by law or consent of parties authority to receive evidence, or shall be acted upon, registered or authenticated by any such person or by any public officer, unless such instrument is duly stamped :

Provided that—

(a)any such instrument shall be admitted in evidence on payment of the duty with which the same is chargeable, or, in the case of any instrument insufficiently stamped, of the amount required to make up such duty, together with a penalty of five rupees, or, when ten times the amount of the proper duty or deficient portion thereof exceeds five rupees, of a sum equal to ten times such duty or portion;

(b)… … … …”[Para No.17]

Section 39(1)(b) of the Indian Stamp Act, 1899 came for consideration before this Court in Gangtappa and another vs. Fakkirappa, 2019(3) SCC 788 (of which one of us Ashok Bhushan, J. was a member). This Court noticed the legislative scheme and held that the legislature has never contemplated that in all cases penalty to the extent of ten times should be ultimately realized. In paragraph 16 following has been laid down by this Court:

“16. Deputy Commissioner under Section 38 is empowered to refund any portion of the penalty in excess of five rupees which has been paid in respect of such instrument. Section 38 Sub-section (1) again uses the expression "if he thinks fit". Thus, in cases where penalty of 10 times has been imposed, Deputy Commissioner has discretion to direct the refund of the penalty in facts of a particular case. The power to refund the penalty Under Section 38 clearly indicates that legislature have never contemplated that in all cases penalty to the extent of 10 times should be ultimately realised. Although the procedural part which provides for impounding and realisation of duty and penalty does not give any discretion Under Section 33 for imposing any lesser penalty than 10 times, however, when provision of Section 38 is read, the discretion given to Deputy Commissioner to refund the penalty is akin to exercise of the jurisdiction Under Section 39 where while determining the penalty he can impose the penalty lesser than 10 times.”[Para No.19]

The expression “if he thinks fit” also occurs in Section 40 sub-clause (b). The same legislative scheme as occurring in Section 39 is also discernible in Section 40(b), there is no legislative intentment that in all cases penalty to the extent of ten times the amount of proper stamp duty or deficient portion should be realised. The discretion given to Collector by use of expression “if he thinks fit” gives ample latitude to Collector to apply his mind on the relevant factors to determine the extent of penalty to be imposed for a case where instrument is not duly stamped. U navoidable circumstances including the conduct of the party, his intent are the relevant factors to come to a decision.[Para No.20]