The Consumer Protection Act, 1986 does not override the Contract Act, 1872, and other enactments

"Consumer is a merely a trustee of vehicle under hire-purchase agreement"

The State Commission further found that there was no mention of the amount due to be paid by the Complainant to the Financier, in the Written Statement filed by the Financier before the District Forum. There was also no mention in that written statement of when the vehicle had been sold and the amount for which the vehicle had been sold, whether such amount was more than or less than the amount due from the Complainant to the Financier. Observing that the silence on the part of the Financier in not divulging anything about the sale rendered the sale ‘dubious’, the State Commission concluded that the Financier had surreptitiously sold the vehicle, without the knowledge of the Complainant, without notice to the Complainant, and without disclosing the details of the sale.[Para No.47]

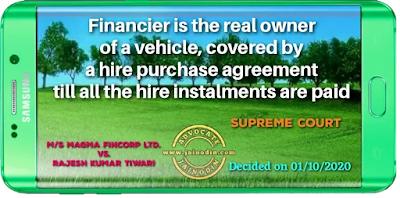

The aforesaid observation, of the sale being dubious, has been made, overlooking the terms and conditions of the hire purchase agreement, and without considering the law governing hire purchase agreements. The Financier remains the owner of the vehicle taken by the complainant on hire, on condition of option to purchase, upon payment of all hire instalments. The hire instalments are charges for use of the vehicle as also for the exercise of option to purchase the vehicle in future. The Financier being the owner of the vehicle, there was no obligation on the part of the Financier, to divulge details of the sale of that vehicle, and that too on its own, without being called upon to do so.[Para No.48

.........

.......

The District Forum, as also the State Commission and the National Commission, did not consider the law relating to hire purchases as enunciated by this Court in a plethora of judgements. [Para no.63]

In Charanjit Singh Chadha & Ors. v. Sudhir Mehra, relied upon by the Financier, this Court held:

“5. Hire-purchase agreements are executory contracts under which the goods are let on hire and the hirer has an option to purchase in accordance with the terms of the agreement. These types of agreements were originally entered into between the dealer and the customer and the dealer used to extend credit to the customer. But as hire- purchase scheme gained in popularity and in size, the dealers who were not endowed with liberal amount of working capital found it difficult to extend the scheme to many customers. Then the financiers came into the picture.The finance company would buy the goods from the dealer and let them to the customer under hire-purchase agreement. The dealer would deliver the goods to the customer who would then drop out of the transaction leaving the finance company to collect instalments directly from the customer. Under hire-purchase agreement, the hirer is simply paying for the use of the goods and for the option to purchase them. The finance charge, representing the difference between the cash price and the hire-purchase price, is not interest but represents a sum which the hirer has to pay for the privilege of being allowed to discharge the purchase price of goods by instalments. 7. In Damodar Valley Corpn. v. State of Bihar AIR 1961 SC 440 this Court took the view that a mere contract of hiring, without more, is a species of the contract of bailment, which does not create a title in the bailee, but the law of hire purchase has undergone considerable development during the last half a century or more and has introduced a number of variations, thus leading to categories and it becomes a question of some nicety as to which category a particular contract between the parties comes under.Ordinarily, a contract of hire purchase confers no title on the hirer, but a mere option to purchase on fulfilment of certain conditions. But a contract of hire purchase may also provide for the agreement to purchase the thing hired by deferred payments subject to the condition that title to the thing shall not pass until all the instalments have been paid. There may be other variations of a contract of hire purchase depending upon the terms agreed between the parties. When rights in third parties have been created by acts of parties or by operation of law, the question may arise as to what exactly were the rights and obligations of the parties to the original contract.[Para no.64]

In Charanjit Singh Chadha (supra), this Court held that

.........