06 December 2020

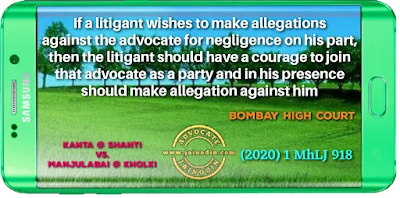

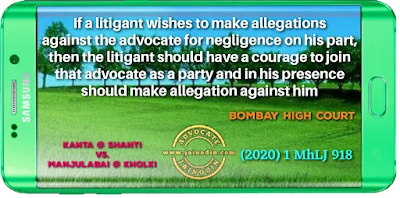

If a litigant wishes to make allegations against the advocate for negligence on his part, then the litigant should have a courage to join that advocate as a party and in his presence should make allegation against him

05 December 2020

Accused in cheque bounce case cannot take benefit if complainant has not shown the transaction in Income-Tax returns

"Further, it has been observed thatthere is no provision in Income-Tax Act, which makes an amount not shown in the income- tax returns unrecoverable. If some amounts are not accounted for, the person would be visited with the penalty or at times even prosecution under Income-Tax Act, but it does not mean that the borrower can refuse to pay the amount which he has borrowed simply, because there is some infraction of the provisions of the Income-Tax Act." [Para No.12]

"The object of introducing S. 269 is to ensure that a tax payer is not allowed to give false explanation for his unaccounted money, or if he has given some false entries in his accounts, he shall not escape by giving false explanation for the same. During search and seizure unaccounted money is unearthed and the tax payer would usually give the explanation that he had borrowed or received deposits from his relatives or friends sand it is easy for the so-called lender also to manipulate his records later to suit the plea of the tax-payer. The main object of S. 269-SS was to curb this menace."[Para No.13]

29 November 2020

Investigation and filling of chargesheet under The Immoral Traffic (Prevention) Act, 1956 should be done only by Special Police Officer empowered under Section 13 of the Act

"4. There is also yet another aspect that is required to be looked into. Under S.13 of the Act, a Special Police Officer shall be appointed 'for dealing with the offences under this Act in that area'. 'Dealing with the case' means doing everything connected with the progress of the case. The Supreme Court in the decision referred supra considered that question and held that the expression would include detection, prevention and investigation of offences and other duties which have been specifically imposed on the Special Police Officer under the Act. It is seen from the records that investigation of the case was conducted by the Circle Inspector though, as authorised by the Special Police Officer and the role of the Special Police Officer was only to verify the investigation and submit final report.S.14(ii) of the Act does not empower the Special Police Officer to authorise investigation of the case to be conducted by any other officer. If that be so the investigation conducted by the officer other than the Special Police Officer is against the provisions of law. "[Para No.8]

17 November 2020

Magistrate; after taking cognizance, cannot issue, at the first instance, non bailable arrest warrant against accused who has obtained anticipatory bail

15 November 2020

Absence of proof of motive creates a doubt regarding the mens rea entitling the accused for an acquittal

11 November 2020

In investigation police should consider the defence put forth by the accused which if investigated fairly, may exonerate him

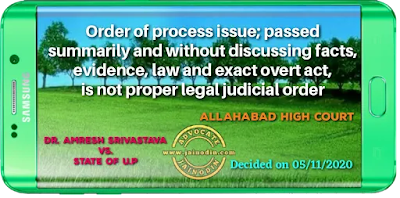

07 November 2020

Order of process issue u/s.204 of Cr.P.C.; passed summarily and without discussing facts, evidence, law and exact overt act, is not proper legal judicial order

04 November 2020

Mesne profits and interest thereon received under the direction of the Civil Court is revenue receipt and is liable to tax u/s. 23(1) of the Income Tax Act

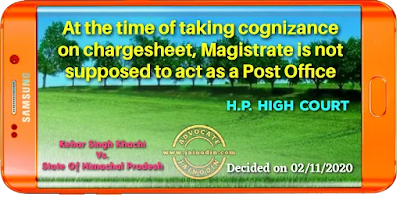

03 November 2020

At the time of taking cognizance on chargesheet, Magistrate is not supposed to act as a Post Office

At the time of consideration of charge Magistrate can take into consideration certain facts and documents pointed out and/or submitted by or on behalf of accused

Filing of Civil Suit for redressal of damages does not bar a person from initiating a criminal case involving ingredients of criminal offence entitling plaintiff/complainant to initiate criminal case against the offender

01 November 2020

Wife can proceed simultaneously under both the provisions of Sec.125 of CrPC and Sec.12 of The Protection Of Women From Domestic Violence Act

27 October 2020

Bail can not be denied to chargesheeted accused on the ground of abscondence of other accused

26 October 2020

Mere existence of motive to commit an offence by itself cannot give rise to an inference of guilt nor can it form the basis for conviction

22 October 2020

There is no limitation of period for invoking High Court's inherent powers u/s.482 Cr.P.C.

If evidence is relevant, it is admissible irrespective of how it is obtained

The Investigating Agency has no power to appreciate the evidence

18 October 2020

The proof of demand is an indispensable essentiality to prove the offence under The Prevention of Corruption Act

17 October 2020

Bail should be granted or refused based on the probability of attendance of the party to take his trial

By now it is well settled that

gravity alone cannot be a decisive ground to deny bail, rather competing factors are required to be balanced by the court while exercising its discretion. It has been repeatedly held by the Hon'ble Apex Court thatobject of bail is to secure the appearance of the accused person at his trial by reasonable amount of bail. The object of bail is neither punitive nor preventative. The Hon'ble Apex Court in Sanjay Chandra versus Central Bureau of Investigation (2012)1 Supreme Court Cases 49; has been held as under: "The object of bail is to secure the appearance of the accused person at his trial by reasonable amount of bail.The object of bail is neither punitive nor preventative. Deprivation of liberty must be considered a punishment, unless it can be required to ensure that an accused person will stand his trial when called upon.The Courts owe more than verbal respect to the principle that punishment begins after conviction, and that every man is deemed to be innocent until duly tried and duly found guilty. Detention in custody pending completion of trial could be a cause of great hardship. From time to time, necessity demands that some unconvicted persons should be held in custody pending trial to secure their attendance at the trial but in such cases, "necessity" is the operative test. In India , it would be quite contrary to the concept of personal liberty enshrined in the Constitution that any person should be punished in respect of any matter, upon which, he has not been convicted or that in any circumstances, he should be deprived of his liberty upon only the belief that he will tamper with the witnesses if left at liberty, save in the most extraordinary circumstances. Apart from the question of prevention being the object of refusal of bail,one must not lose sight of the fact that any imprisonment before conviction has a substantial punitive content and it would be improper for any court to refuse bail as a mark of disapproval of former conduct whether the accused has been convicted for it or not or to refuse bail to an unconvicted person for the propose of giving him a taste of imprisonment as a lesson." [Para No.5]

Needless to say

14 October 2020

Mere recovery of blood stained weapon cannot be construed as proof for the murder

For proving the contents of memorandum prepared u/s.27 of Evidence Act, the Investigating Officer must state the exact narration of facts in such document in his own words while deposing before the Court

17. Now as regards the proving of such information, the matter seems to us to be governed by Sections 60, 159 and 160 of the Evidence Act. It is correct thatstatements and reports prepared outside the court cannot by themselves be accepted as primary or substantive evidence of the facts stated therein. Section 60 of the Evidence Act lays down that oral evidence must, in all cases whatever, be direct, that is to say, if it refers to a fact which could be seen, it must be the evidence of a witness who says he saw it, and if it refers to a fact which could be heard, it must be the evidence of a witness who says he heard it and so on. Section 159 then permits a witness while under examination to refresh his memory by referring to any writing made by himself at the time of the transaction concerning which he is questioned, or so soon afterwards that the court considers it likely that the transaction was at that time fresh in the memory. Again, with the permission of the court, the witness may refresh, his memory by referring to a copy of such document. And the witness may even refer to any such writing made by any other person but which was read by him at the time the transaction was fresh in his memory and when he read it, he knew it to be correct. Section 160 then provides for cases where the witness has no independent recollection say, from lapse of memory, of the transaction to which he wants to testify by looking at the document and states that although he has no such recollection he is sure that the contents of the document were correctly recorded at the time they were. It seems to us that where a case of this character arises and the document itself has been tendered in evidence, the document becomes primary evidence in the case. See Jagan Nath v. Emperor, AIR 1932 Lah 7.The fundamental distinction between the two sections is that while under Section 159 it is the witness's memory or recollection which is evidence, the document itself not having been tendered in evidence; under Section 160, it is the document which is evidence of the facts contained in it. It has been further held that in order to bring a case under Section 160, though the witness should ordinarily affirm on oath that he does not recollect the facts mentioned in the document, the mere omission to say so will not make the document inadmissible provided the witness swears that he is sure that the facts are correctly recorded in the document itself. Thus in Partab Singh v. Emperor, AIR 1926 Lah 310 it was held that where the surrounding circumstances intervening between the recording of a statement and the trial would as a matter of normal human experience render it impossible for a police officer to recollect and reproduce the words used, his statement should be treated as if he had prefaced it by stating categorically that he could not remember what the deceased in that case had said to him. Putting the whole thing in somewhat different language, what was held was that Section 160 of the Act applies equally when the witness states in so many words that he has no independent recollection of the precise words used, or when it should stand established beyond doubt that that should be so as a matter of natural and necessary conclusion from the surrounding circumstances.18. Again, in Krishnama v. Emperor, AIR 1931 Mad 430 a Sub-Assistant Surgeon recorded the statement made by the deceased just before his death, which took place in April, 1930, and the former was called upon to give evidence some time in July, 1930. In the Sessions Court he just put in the recorded statement of the deceased which was admitted in evidence. On appeal it was objected that such statement was wrongly admitted inasmuch as the witness did not use it to refresh his memory nor did he attempt from recollection to reproduce the words used by the accused. It was held that he could not have been expected to reproduce the words of the deceased, and therefore, he was entitled to put in the document as a correct record of what the deponent had said at the time on the theory that the statement should be treated as if the witness had prefaced it by stating categorically that he could not remember what the deceased had said.19. Again in Public Prosecutor v. Venkatarama Naidu, AIR 1943 Mad 542, the question arose how the notes of a speech taken by a police officer be admitted in evidence. It was held that it was not necessary that the officer should be made to testify orally after referring to those notes. The police officer should describe his attendance, the making of the relevant speech and give a description of its nature so as to identify his presence there and his attention to what was going on, and that after that it was quite enough it he said "I wrote down that speech and this is what I took down," and if the prosecution had done that, they would be considered to have proved the words. This case refers to a decision of the Lahore High Court in Om Prakash v. Emperor, AIR 1930 Lah 867 wherein the contention was raised that the notes of a speech taken by a police officer were not admissible in evidence as he did not testify orally as to the speech and had not refreshed his memory under Section 159 of the Evidence Act from those notes. It was held that instead of deposing orally as to the speech made by the appellant, the police officer had put in the notes made by him, and that there would be no difference between this procedure and the police officer deposing orally after reference to those notes, and that for all practical purposes, that would be one and the same thing.20. The same view appears to us to have been taken in Emperor v. Balaram Das, AIR 1922 Cal 382 (2).21. From the discussion that we have made, we think that the correct legal position is somewhat like this.Normally, a police officer (or a Motbir) should reproduce the contents, of the statement made by the accused under Section 27 of the Evidence Act in Court by refreshing his memory under Section 159 of the Evidence Act from the memo earlier prepared thereof by him at the time the statement had been made to him or in his presence and which was recorded at the same time or soon after the making of it and that would be a perfectly unexceptionable way of proving such a statement. We do not think in this connection, however, that it would be correct to say that he can refer to the memo under Section 159 of the Evidence Act only if he establishes a case of lack of recollection and not otherwise. We further think that where the police officer swears that he does not remember the exact words used by the accused from lapse of time or a like cause or even where he does not positively say so but it is reasonably established from the surrounding circumstances (chief of which would be the intervening time between the making of the statement and the recording of the witness's deposition at the trial) that it could hardly be expected in the natural course of human conduct that he could or would have a precise or dependable recollection of the same, then under Section 160 of the Evidence Act, it would be open to the witness to rely on the document itself and swear that the contents thereof are correct where he is sure that they are so and such a case would naturally arise where he happens to have recorded the statement himself or where it has been recorded by some one else but in his own presence, and in such a case the document itself would be acceptable substantive evidence of the facts contained therein. With respect, we should further make it clear that in so far as Chhangani, J.'s holds to the contrary, we are unable to accept it as laying down the correct law. We hold accordingly."

Rejection of a bail application by Sessions Court does not operate as a bar for the High Court in entertaining a similar application under Section 439 Cr. P. C.

In the instant case, learned Principal Sessions Judge, Samba, has rejected the bail petition of both the petitioners. The question that arises for consideration is whether or not successive bail applications will lie before this Court. The law on this issue is very clear that

"It is significant to note that under Section 397, Cr.P.C of the new Code while the High Court and the Sessions Judge have the concurrent powers of revision, it is expressly provided under sub-section (3) of that section that when an application under that section has been made by any person to the High Court or to the Sessions Judge, no further application by the same person shall be entertained by the other of them. This is the position explicitly made clear under the new Code with regard to revision when the authorities have concurrent powers. Similar was the position under Section 435(4), Cr.P.C of the old Code with regard to concurrent revision powers of the Sessions Judge and the District Magistrate. Although, under Section 435(1) Cr.P.C of the old Code the High Court, a Sessions Judge or a District Magistrate had concurrent powers of revision, the High Court's jurisdiction in revision was left untouched. There is no provision in the new Code excluding the jurisdiction of the High Court in dealing with an application under Section 439(2), Cr.P.C to cancel bail after the Sessions Judge had been moved and an order had been passed by him granting bail. The High Court has undoubtedly jurisdiction to entertain the application under Section 439(2), Cr.P.C for cancellation of bail notwithstanding that the Sessions Judge had earlier admitted the appellants to bail. There is, therefore, no force in the submission of Mr Mukherjee to the contrary."[Para No.5]

"The above view of the learned Single Judge of the Kerala High Court appears to me to be correct. In fact, it is now well-settled that

there is no bar whatsoever for a party to approach either the High Court or the Sessions Court with an application for an ordinary bail made under Section 439 Cr.P.C. The power given by Section 439 to the High Court or to the Sessions Court is an independent power and thus, when the High Court acts in the exercise of such power it does not exercise any revisional jurisdiction, but its original special jurisdiction to grant bail. This being so, it becomes obvious that although under section 439 Cr.P.C. concurrent jurisdiction is given to the High Court and Sessions Court,the fact, that the Sessions Court has refused a bail under Section 439 does not operate as a bar for the High Court entertaining a similar application under Section 439 on the same facts and for the same offence. However,if the choice was made by the party to move first the High Court and the High Court has dismissed the application, then the decorum and the hierarchy of the Courts require that if the Sessions Court is moved with a similar application on the same fact, the said application be dismissed. This can be inferred also from the decision of the Supreme Court in Gurcharan Singh's case (above)."[Para No.6]

13 October 2020

While deciding an application for rejection of plaint under Order VII Rule 11 CPC, the court is required to take the averments made therein to be correct

"10. Clause (d) of Order 7 Rule 11 speaks of suit, as appears from the statement in the plaint to be barred by any law.Disputed questions cannot be decided at the time of considering an application filed under Order 7 Rule 11 CPC. Clause (d) of Rule 11 of Order 7 applies in those cases only where the statement made by the plaintiff in the plaint, without any doubt or dispute shows that the suit is barred by any law in force.19. There cannot be any compartmentalisation, dissection, segregation and inversions of the language of various paragraphs in the plaint. If such a course is adopted it would run counter to the cardinal canon of interpretation according to which a pleading has to be read as a whole to ascertain its true import. It is not permissible to cull out a sentence or a passage and to read it out of the context in isolation. Although it is the substance and not merely the form that has to be looked into, the pleading has to be construed as it stands without addition or subtraction of words or change of its apparent grammatical sense. The intention of the party concerned is to be gathered primarily from the tenor and terms of his pleadings taken as a whole. At the same time it should be borne in mind that no pedantic approach should be adopted to defeat justice on hair-splitting technicalities." (emphasis added)[Para No.16]

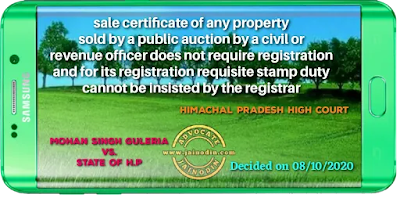

09 October 2020

sale certificate of any property sold by a public auction by a civil or revenue officer does not require registration and for its registration requisite stamp duty cannot be insisted by the registrar

"24. Learned Senior Counsel appearing on behalf of the writ petitioner argued that the authorities concerned have refused to register the sale and make the entries in the revenue records on the ground that the necessary permission was to be obtained as per the mandate of Section 118 of the Act.25. It is also contended that the sale certificate and the confirmation of sale issued by the authorities, i.e. Annexures P6 and P8, are necessary to be registered before the authority concerned in terms of the mandate of Section 17 of the Registration Act, 1908 (for short "the Registration Act"), which is not legally correct.

26.Section 17 of the Registration Act, though mandatory in nature, provides which of the documents are compulsory to be registered. It does not include sale by auction and sale certificate issued by the concerned authorities including confirmation of sale, which are outcome of the auction proceedings conducted in terms of Court orders. The provision is speaking one and without any ambiguity.Thus, registration was not required. The Apex Court in the case titled as B. Arvind Kumar versus Govt. of India and others, 2007 5 SCC 745 , held thata sale certificate issued by a Court or an officer authorized by the Court does not require registration. It is apt to reproduce para 12 of the judgment herein:

"12. The plaintiff has produced the original registered sale certificate dated 29.8.1941 executed by the Official Receiver, Civil Station, Bangalore. The said deed certifies that Bhowrilal (father of plaintiff) was the highest bidder at an auction sale held on 22.8.1941, in respect of the right, title, interest of the insolvent Anraj Sankla, namely the leasehold right in the property described in the schedule to the certificate (suit property), that his bid of Rs. 8,350.00 was accepted and the sale was confirmed by the District Judge, Civil and Military Station, Bangalore on 25.8.1941. The sale certificate declared Bhowrilal to be the owner of the leasehold right in respect of the suit property. When a property is sold by public auction in pursuance of an order of the court and the bid is accepted and the sale is confirmed by the court in favour of the purchaser, the sale becomes absolute and the title vests in the purchaser. A sale certificate is issued to the purchaser only when the sale becomes absolute. The sale certificate is merely the evidence of such title. It is well settled thatwhen an auction purchaser derives title on confirmation of sale in his favour, and a sale certificate is issued evidencing such sale and title, no further deed of transfer from the court is contemplated or required. In this case,the sale certificate itself was registered, though such a sale certificate issued by a court or an officer authorized by the court, does not require registration. Section 17(2)(xii) of the Registration Act, 1908 specifically provides thata certificate of sale granted to any purchaser of any property sold by a public auction by a civil or revenue officer does not fall under the category of non testamentary documents which require registration under subsec. (b) and (c) of sec. 17(1) of the said Act. We therefore hold that the High Court committed a serious error in holding that the sale certificate did not convey any right, title or interest to plaintiff's father for want of a registered deed of transfer."

28. The same principle has been laid down by the Apex Court in the case titled as Som Dev and others versus Rati Ram and another, 2006 10 SCC 788 . It would be profitable to reproduce para 15 of the judgment herein:

"15. Almost the whole of the argument on behalf of the appellants here, is based on the ratio of the decision of this Court in Bhoop Singh v. Ram Singh Major, 1995 5 SCC 709 , It was held in that case that exception under clause (vi) of Section 17(2) of the Act is meant to cover that decree or order of a Court including the decree or order expressed to be made on a compromise which declares the preexisting right and does not by itself create new right, title or interest in praesent in immovable property of the value of Rs.100/ or upwards. Any other view would find the mischief of avoidance of registration which requires payment of stamp duty embedded in the decree or order. It would, therefore, be the duty of the Court to examine in each case whether the parties had preexisting right to the immovable property or whether under the order or decree of the Court one party having right, title or interest therein agreed or suffered to extinguish the same and created a right in praesenti in immovable property of the value of Rs.100/ or upwards in favour of the other party for the first time either by compromise or pretended consent. If latter be the position, the document is compulsorily registrable. Their Lordships referred to the decisions of this Court in regard to the family arrangements and whether such family arrangements require to be compulsorily registered and also the decision relating to an award. With respect, we may point out that an award does not come within the exception contained in clause (vi) of Section 17(2) of the Registration act and the exception therein is confined to decrees or orders of a Court. Understood in the context of the decision in Hemanta Kumari Debi v. Midnapur Zamindari Co. Ltd., 1919 AIR(PC) 79 and the subsequent amendment brought about in the provision, the position that emerges is thata decree or order of a court is exempted from registration even if clauses (b)and (c) of Section 17(1) of the Registration Act are attracted, and even a compromise decree comes under the exception, unless, of course, it takes in any immovable property that is not the subject matter of the suit.

29. A question arose before the Madras High Court in a case titled as K. Chidambara Manickam versus Shakeena & Ors., 2008 AIR(Mad) 108 , whether the sale of secured assets in public auction which ended in issuance of a sale certificate is a complete and absolute sale or whether the sale would become final only on the registration of the sale certificate? It has been held that the sale becomes final when it is confirmed in favour of the auction purchaser, he is vested with rights in relation to the property purchased in auction on issuance of the sale certificate and becomes the absolute owner of the property. The sale certificate does not require any registration. It is apt to reproduce paras 10.13, 10.14, 10.17 and 10.18 of the judgment herein:-

"10.13 Part III of the Registration Act speaks of the Registration of documents. Section 17(1) of the Registration Act enumerates the documents which require compulsory Registration. However, subsection (2) of Section 10 sets out the documents to which clause (b) and (c) of subsection (1) of Section 17 do not apply. Clause (xii) of subsection (2) of Section 17 of the Registration Act reads as under:"Section 17(2)(xii) any certificate of sale granted to the purchaser of any property sold by public auction by a Civil or Revenue Officer."

10.14 A Division Bench of this Court in Arumugham, S. v. C.K. Venugopal Chetty,1994 1 LW 491 , held that the property transferred by Official Assignee, under order of Court, does not require registration under Section 17 of the Registration Act. The Division Bench has held as follows: