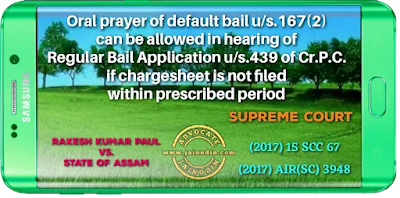

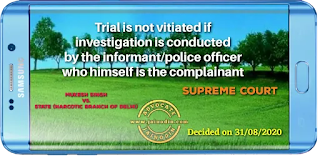

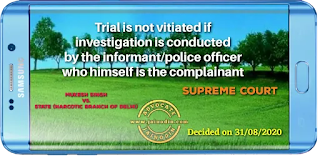

Now we consider the relevant provisions of the Cr. P. C. with respect to the investigation.

Section 154 Cr.P.C. provides that every information relating to the commission of a cognizable offence, if given orally to an officer in charge of a police station, shall be reduced to writing by him or under his direction.

Section 156 Cr.P.C. provides that any officer in charge of a police station may investigate any cognizable offence without the order of a Magistrate. It further provides that no proceeding of a police officer in any such case shall at any stage be called in question on the ground that the case was one which such officer was not empowered under this section to investigate. Therefore, as such, a duty is cast on an officer in charge of a police station to reduce the information in writing relating to commission of a cognizable offence and thereafter to investigate the same.

Section 157 Cr.P.C. specifically provides that if, from information received or otherwise, an officer in charge of a police station has reason to suspect the commission of an offence which he is empowered under Section 156 to investigate, he shall forthwith send a report of the same to a Magistrate empowered to take cognizance of such offence upon a police report and shall proceed in person to the spot to investigate the facts and circumstances of the case and, if necessary, to take measures for the discovery and arrest of the offender.

Therefore, considering Section 157 Cr.P.C., either on receiving the information or otherwise (may be from other sources like secret information, from the hospital, or telephonic message), it is an obligation cast upon such police officer, in charge of a police station, to take cognizance of the information and to reduce into writing by himself and thereafter to investigate the facts and circumstances of the case, and, if necessary, to take measures for the discovery and arrest of the offender. Take an example, if an officer in charge of a police station passes on a road and he finds a dead body and/or a person being beaten who ultimately died and there is no body to give a formal complaint in writing, in such a situation, and when the said officer in charge of a police station has reason to suspect the commission of an offence, he has to reduce the same in writing in the form of an information/complaint. In such a situation, he is not precluded from further investigating the case. He is not debarred to conduct the investigation in such a situation. It may also happen that an officer in charge of a police station is in the police station and he receives a telephonic message, may be from a hospital, and there is no body to give a formal complaint in writing, such a police officer is required to reduce the same in writing which subsequently may be converted into an FIR/complaint and thereafter he will rush to the spot and further investigate the matter. There may be so many circumstances like such. That is why, Sections 154, 156 and 157 Cr.P.C. come into play.[Para No.9]